Writing a Powerful Bank Account Opening Letter (Free Sample)

As someone who has navigated the sometimes confusing world of banking, I want to share with you a straightforward guide on how to write a bank account opening letter.

Bank Account Opening Letter Generator

Key takeaways.

- Understand the importance and purpose of a bank account opening letter.

- Follow a step-by-step guide to write an effective letter.

- Utilize a customizable template for your convenience.

- Learn tips for ensuring your letter meets bank requirements.

- Discover how to personalize your letter for different situations.

Whether you’re a student stepping into the world of finance, a professional looking to manage your earnings, or simply someone wanting to organize your financial life, this guide is for you.

I’ll walk you through each step, from understanding the purpose of this letter to crafting one that meets your unique needs.

Understanding the Purpose of a Bank Account Opening Letter

Before diving into the writing process, it’s crucial to understand what a bank account opening letter is and why it’s important.

Essentially, this letter is a formal request to a bank for opening a new account in your name.

Trending Now: Find Out Why!

It’s a critical step in establishing a relationship with your bank and lays the groundwork for your financial management.

Why Write a Bank Account Opening Letter?

- Formalizes Your Request : It’s a professional way to communicate with the bank.

- Provides Necessary Information : The letter includes all the details the bank needs.

- Serves as a Personal Record : Keeps a record of your banking intentions and requirements.

Step-by-Step Guide to Writing the Letter

Step 1: collect necessary information.

Before you start writing, gather all the information you’ll need. This includes:

- Your personal details (name, address, contact information).

- The type of account you want to open (savings, checking, etc.).

- Any specific features or services you require.

Step 2: Choose the Right Format

A bank account opening letter should be formal and concise. Use a standard business letter format:

- Your Address

- Bank’s Address

- Salutation (e.g., Dear [Bank Manager’s Name])

Step 3: Write the Body of the Letter

In the first paragraph, state your purpose clearly – opening a new account. In the following paragraphs, provide your personal information and specify the type of account you wish to open.

Step 4: Close the Letter

Conclude with a polite request for the bank to process your application and provide any necessary instructions for the next steps.

Step 5: Proofread and Sign

Always proofread your letter for errors. A well-written, error-free letter reflects your seriousness. Don’t forget to sign the letter.

Bank Account Opening Letter Templates

1. basic bank account opening letter for an individual.

[Your Name] [Your Address] [City, Zip Code] [Date]

Branch Manager [Bank Name] [Branch Address] [City, Zip Code]

Subject: Request to Open a New Savings Account

Dear Sir/Madam,

I am writing to request the opening of a new savings account in my name at your esteemed branch. I would like to complete the formalities and provide any necessary documentation at your earliest convenience.

Please find my details below for your reference:

- Full Name: [Your Full Name]

- Date of Birth: [Your DOB]

- Residential Address: [Your Address]

- Phone Number: [Your Contact Number]

- Email ID: [Your Email Address]

I am ready to submit the required identity, address proof, and passport-size photographs as per your guidelines. Please let me know if any additional forms or documents are required.

Thank you for your assistance, and I look forward to a positive response.

Yours sincerely,

[Your Signature] [Your Printed Name]

2. Bank Account Opening Letter for a Business

[Your Name] [Position in Company] [Company Name] [Company Address] [City, Zip Code] [Date]

Subject: Request to Open a New Business Account

I am writing on behalf of [Company Name] to request the opening of a business account. As our company is expanding, we require a business bank account to streamline our financial operations.

Please find our business details below:

- Company Name: [Your Company Name]

- Business Registration Number: [Registration Number]

- Business Address: [Company Address]

- Type of Account Required: Business Current Account

I am enclosing the necessary documents, including proof of business registration, identity documents of authorized signatories, and any other requirements as specified by your branch. Please inform me of any additional steps we need to complete.

Thank you for your attention to this matter. We look forward to a successful association with [Bank Name].

[Your Signature] [Your Name] [Your Position]

3. Bank Account Opening Letter for a Minor Account

[Parent/Guardian’s Name] [Your Address] [City, Zip Code] [Date]

Subject: Request to Open a Minor Savings Account

I am writing to request the opening of a minor savings account on behalf of my child, [Child’s Full Name] , who is [Age] years old. As the legal guardian, I wish to initiate a savings account in their name to encourage financial responsibility from an early age.

The details of the account holder and myself are as follows:

- Minor’s Name: [Child’s Full Name]

- Date of Birth: [Child’s DOB]

- Guardian’s Name: [Your Full Name]

- Relationship to Minor: Parent/Guardian

- Address: [Your Address]

Please let me know if additional documentation is required. I am prepared to submit proof of identity, address, and any other forms required by the bank.

Thank you for your guidance in setting up this account.

Warm regards,

Tips for an Effective Letter

- Be Clear and Concise : Avoid unnecessary details.

- Personalize Your Letter : Tailor the letter to reflect your specific needs and circumstances.

- Double-Check Bank Requirements : Ensure you include all necessary information.

- Professional Tone : Maintain a formal and respectful tone throughout the letter.

Personalizing Your Letter for Different Situations

- For Students : Mention your student status as some banks offer special accounts for students.

- For Business Owners : Specify the nature of your business and any specific business banking needs.

Writing a bank account opening letter might seem daunting at first, but with the right guidance, it’s quite straightforward.

Use this guide and template to create a letter that clearly communicates your needs to the bank.

Remember, a well-crafted letter can make your banking experience smoother and more efficient.

Comment Request

I’d love to hear about your experiences or any additional tips you might have regarding writing a bank account opening letter. Please share your thoughts in the comments below!

Frequently Asked Questions (FAQs)

Q: What is a bank account opening letter?

Answer : A bank account opening letter is a formal document sent to a bank by an individual or a company to request the opening of a new bank account.

It outlines the type of account being requested and may include details such as personal information, the initial deposit, and any specific features or services the applicant wishes to include.

Q: Who needs to write a bank account opening letter?

Answer : A bank account opening letter is typically written by individuals or businesses that intend to establish a new banking relationship. This is more common in corporate banking, where formal requests are necessary to initiate the account creation process.

Q: What information should be included in a bank account opening letter?

Answer : The letter should include the applicant’s full name, address, and contact information, the date, the bank’s name, and branch information. It should clearly state the purpose of the letter, the type of account to be opened, any specific services required, personal identification details, and any accompanying documents.

Q: Can I send a bank account opening letter via email?

Answer : Yes, many banks now accept electronic communication for account opening requests. However, it’s essential to confirm with the specific bank if they accept account opening requests via email and understand their process for electronic submissions.

Q: How formal should the bank account opening letter be?

Answer : The bank account opening letter should be formal and professional. It’s an official request and serves as part of your financial records. Use a formal tone and proper salutations, and close the letter respectfully.

Q: Do I need to include personal identification documents with my bank account opening letter?

Answer : Yes, banks usually require proof of identification and address to open an account. It is advisable to mention in your letter that you have enclosed the necessary documents and list them for clarity.

Q: How do I follow up after sending a bank account opening letter?

Answer : If you do not receive a response within a week or two, you can follow up with a phone call or visit the bank in person. Always keep a copy of your letter and documents sent for your records.

Q: What if I make a mistake in my bank account opening letter?

Answer : If you realize there’s a mistake after sending the letter, contact the bank as soon as possible to correct it. You can do this via phone, email, or a follow-up letter, depending on the bank’s preferred communication method.

MORE FOR YOU

Ultimate loan repayment letter template.

Discover a free sample loan repayment letter template to help you craft a compelling and effective repayment plan.

Read More »

Sample Letter to Bank for Name Change after Marriage

Changing your name after marriage is a significant life event, and one of the essential steps is to update your name with various institutions, including…

Urgent Request Letter to Stop Auto Debit (Free Sample)

If you’ve ever found yourself in a situation where auto-debits have unexpectedly drained your account, you’re not alone. Over the years, I have helped numerous…

Sample Letter Informing Change of Email Address to Bank: Free & Effective

As someone who has written numerous letters to banks about updating email addresses, I understand the nuances of this seemingly simple task. In this article,…

Writing a Simple Cheque Book Request Letter (Free Sample)

In my years of assisting friends and clients with banking documentation, one recurring task has been writing cheque book request letters. While it seems straightforward,…

Sample Letter to Creditors Unable to Pay Due to Death

Through this article, I aim to guide you step-by-step in crafting a compassionate yet effective letter to your creditors, sharing proven templates and personal tips…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Request Letter to Bank for Opening a Current Account (Sample)

A current account becomes necessary to carry out business transactions by an organization, viz., sole proprietorship, company, etc. At the same time, it is usual for a company to operate money and commercial transactions through a current account. In the case of sole proprietors, sometimes they avoid using a current account for their businesses to avoid any additional banking inconvenience. So they carry out the transactions in their own savings account.

However, it is always advisable to open a separate bank account for business purposes as it gives a professional touch to the business dealings and is also helpful in maintaining proper records of all the income and expenditures of the business. Therefore, if you plan to open a current bank account for your business, you will have to write a bank account opening letter to the bank manager.

Similar Post: Request Letter to Bank to Add/ Change/ Update Mobile Number

Bank Account Opening Letter: A Comprehensive Guide

Opening a bank account is crucial for every individual and business. It provides a secure and convenient way to manage money, receive payments, and access various financial services. However, to open a bank account, you need to write an opening letter to the bank, introduce yourself, provide your personal and business information, and request to open an account. This guide will provide you with a comprehensive understanding of bank account opening letters, including their format, content, and sample templates.

1. Introduction

The first paragraph of your bank account opening letter should introduce yourself and your purpose for writing the letter. You must clearly state that you want to open a bank account and provide the bank’s name and location.

2. Personal Information In the second paragraph

you must provide your Personal Information, such as your full name, date of birth, contact information, and social security number. If you are writing on behalf of a business, you need to provide the business name, registration number, and address.

3. Account Details In the third paragraph

you need to provide the account details, such as the type of account you want to open, the account name, and the account number. You also need to specify the initial deposit amount and payment method.

4. Signature and Enclosures In the fourth paragraph

you need to thank the bank for considering your application and request the bank’s signature and seal to confirm the account’s opening. You must also mention the documents enclosed with the letter, such as your ID, business registration certificate, and proof of address.

Similar Post: Letter to Bank for Change of Name and Address after Marriage

TEMPLATE (Letter by Individual / Sole Proprietor)

Date: _________

(Name of the Applicant)

(Full Address)

(Contact No.)

The Branch Manager

(Name of the Bank)

(Name of the Branch)

Sub .: Application for opening of a current account.

Dear Sir/Madam,

I want to request your bank to open a current account in the name of my business. Currently, I am using a savings account for all my transactions, but I believe that it is time for me to upgrade to a current account to make things more convenient and professional.

I have attached all the necessary documents for your perusal. Once the account has been opened, I will be transferring my entire balance from my savings account to my new current account. I would appreciate it if you could process my request as soon as possible.

Thank you for your time and consideration.

Thanking you,

Yours faithfully,

(Signature)

Encl.: As above

TEMPLATE (Letter by a Company)

Date: __________

(Bank’s Name)

(Branch’s Name)

Sub .: Application for opening of a current account for the company.

I am writing to apply to open a current account for my company. We are a small business just starting, and we need a bank account to begin operating.

We would be grateful if you could approve our application and open an account for us. Thank you for your time and consideration.

I am enclosing herewith the following documents for opening of the current account:

- Memorandum and Articles of Association

- Certificate of Incorporation

- List of Directors

- Board Resolution authorizing the opening of bank account

- KYC documents of Directors

- Personal bank account details

- Passport size photograph

For __________ Limited,

(Name of the Authorised Officer)

(Designation, Department)

Conclusion:

In conclusion, writing a bank account opening letter is straightforward and requires attention to detail and accuracy. A well-written letter can help you open a bank account smoothly and quickly, while a poorly written letter can delay or even reject your application. Therefore, it is essential to follow the format and guidelines provided in this guide and provide accurate and complete information.

In summary, the letter should start with an introduction that clearly states your writing purpose. You need to provide your personal information, such as your full name, date of birth, contact information, and social security number, and specify the type of account you want to open, the account name, and the account number. Moreover, you need to mention the initial deposit amount, the payment method, and the documents enclosed with the letter.

By following the above format and providing accurate and complete information, you can increase the chances of your application’s approval. However, each bank may have specific requirements and procedures for opening a bank account, so it is recommended to check with the bank’s website or contact their customer service for more information.

We hope this guide has provided valuable insights into writing a bank account opening letter. If you have any questions or comments, please leave them below. Thank you for reading!

Similar Posts

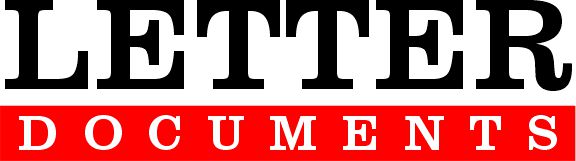

Sample Letter To Insurance Company Requesting Reimbursement

If an employer includes medical allowances in an employee’s contract, the employee can ask to be reimbursed for any medical bills. Typically, companies will not reimburse you for medical expenses outright. Instead, they give money…

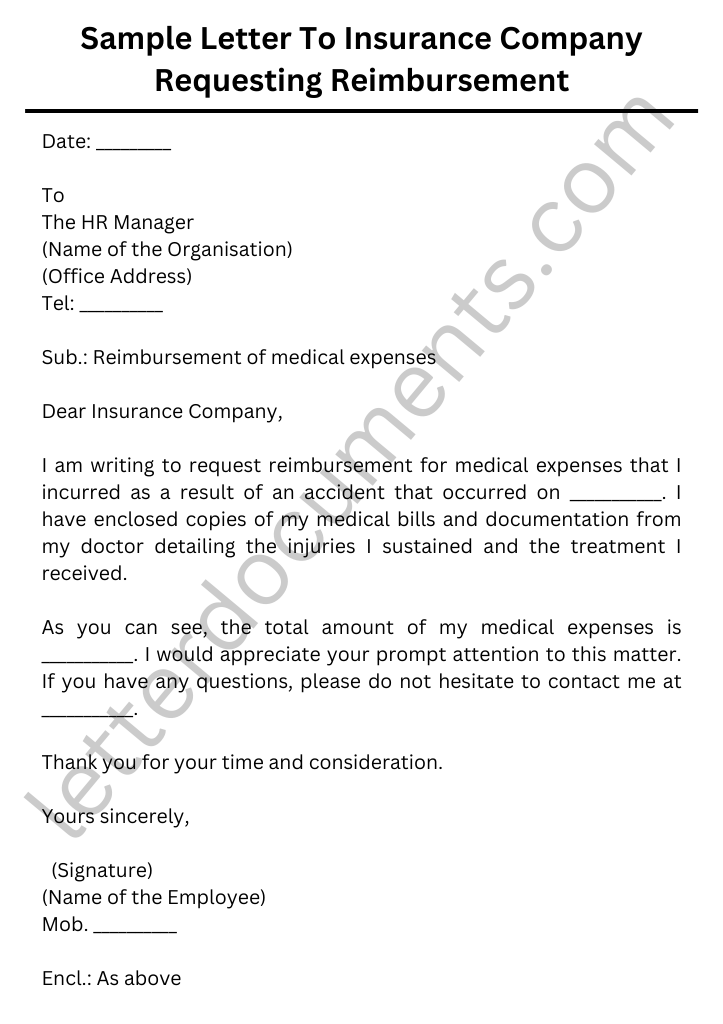

Loan Cancellation Letter

If you are looking to cancel a loan, you should follow these steps: Here’s an example of a loan cancellation letter: TEMPLATE #1 (Letter) [Your Name][Your Address][City, State ZIP Code][Your Contact Details][Date] [Bank Manager’s Name][Bank…

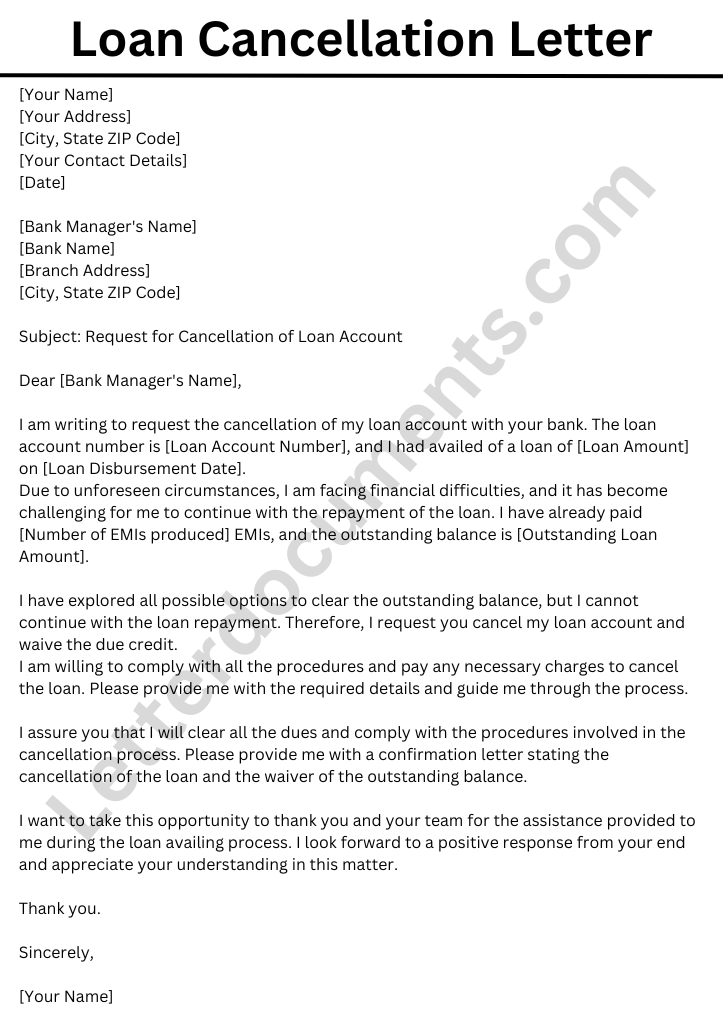

Sample Letter to Bank Manager informing Death of Pensioner

It is the responsibility of the immediate family member of a pensioner to intimate the news of death to the bank through which he was drawing pension. The family member can also request the bank…

Letter to Bank for Change of Name and Address after Marriage

It is a common practice for women to change their name and address after marriage. Many women, who are in employment, do not change their surname after marriage. In such cases, the name and address…

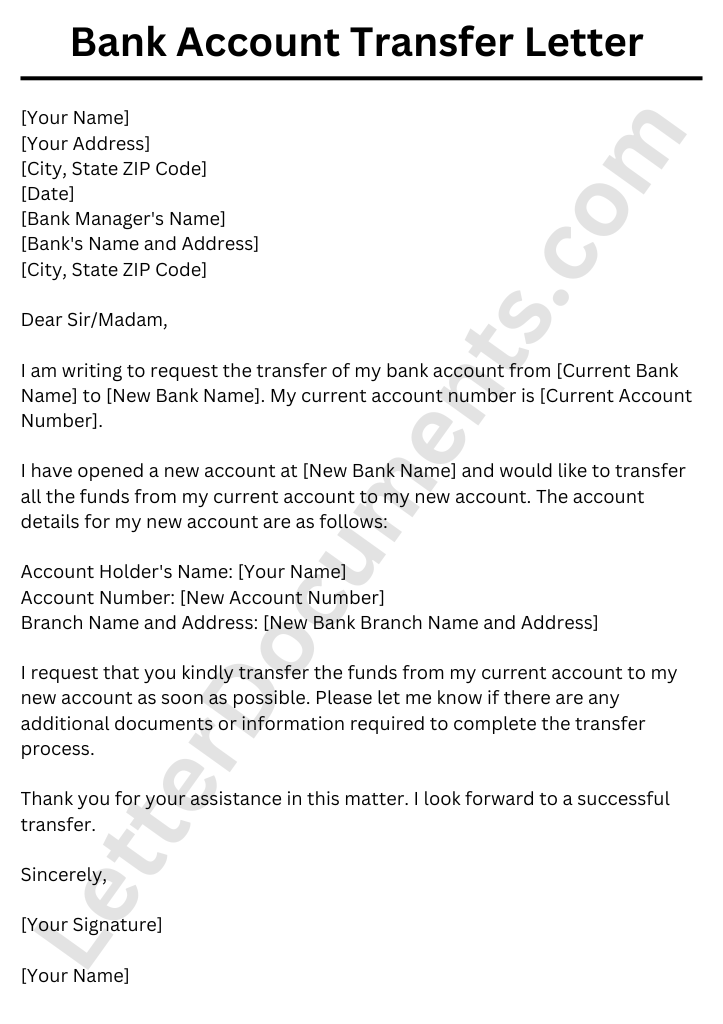

Bank Account Transfer Letter

To write a letter to transfer your bank account, you can follow the steps below: Here’s an example of what a bank account transfer letter might look like: TEMPLATE #1 [Your Name][Your Address][City, State ZIP…

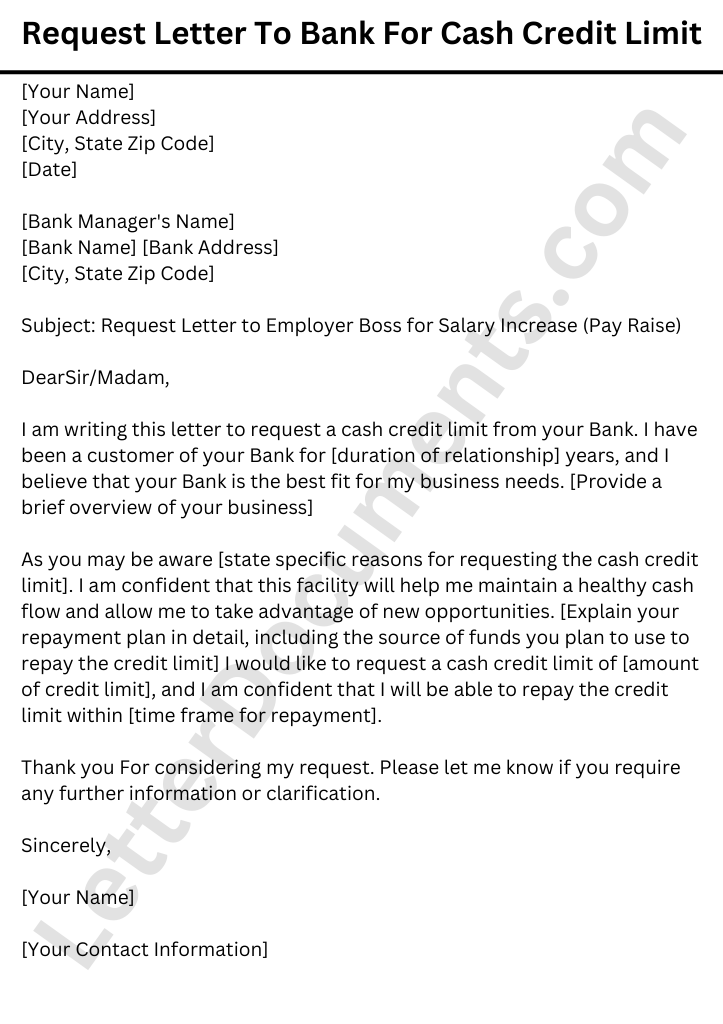

Sample Request Letter To Bank For Cash Credit Limit

Are you looking to expand your business or secure additional financial support from your bank? One effective way to do so is by writing a request letter to your bank for a cash credit limit…

IMAGES