Here’s How to Write an Equity Research Report: The Best Guide

October 17, 2016

Equity Research is a rewarding career.

To keep up, you need a strong foundation with the judgment to think critically, act independently, and be relentlessly analytical.

That’s why I wrote this guide — to empower you with the equity research(ER) report writing skills to stay ahead in the equity research career.

There is almost NO guide available that teaches you how to write an equity research report.

From textbooks to online video tutorials, you can check and let me know if you find one.

And, I felt that I should write a detailed and step-by-step guide— a guide that really starts at the beginning to equip already-intelligent analysts with a healthy balance of conceptual and practical advice.

The Advanced Guide to Equity Research Report Writing takes your writing to the next level.

Who Is This Guide for?

I wrote this guide for an audience of equity research analysts , investment banking professionals, industry analysts, market research professionals, business management students, and freelance writers.

Most of all, I want you to walk away from this guide feeling confident about your equity report writing skill.

What Is an Equity Research Report

This chapter explains what exactly an ER report is.

The questions like—Who makes it? Who reads and uses it? What are the different types of equity research reports?—are answered clearly and elaborately.

It briefly talks about the various key contents of an ER report.

And lastly, it explains the need to provide a disclaimer at the end of an ER report.

So before understanding how to write an ER report, let’s try to understand what exactly an equity ER is.

FINRA , the Financial Industry Regulatory Authority, defines an equity research report, in Rule 2711 (a)(8) as,

“A written or electronic communication that includes an analysis of equity securities of individual companies or industries , and that provides information reasonably sufficient upon which to base an investment decision.

Readers of Equity Research, more so than anything else, identify trends that make investment decisions easier to justify.

In simpler words, equity research is a document written and published by a brokerage house or securities firm for its clients to help them to make better decisions regarding which stocks to choose for profitable investment.

The report should be such that it should convince the client to make a decision.

The report should be crisp; the point of view should be clearly structured and articulated concisely.

In the investment industry, equity reports usually refer to ‘sell-side’ research, or investment research created by brokerage houses.

Such research is circulated to the corporate and retail clients of the brokerage house that publishes it.

Research produced by the ‘buy-side’, which includes mutual funds, pension funds, and portfolio managers, is usually for internal use and is not distributed to outside parties.

a. Different types of equity reports

In the above paragraph, we saw terms such as ‘sell-side’ and ‘buy-side’.

Let’s quickly understand what these terms mean:

There are two main types of equity research reports:

i. Sell-Side reports

Sell-side reports are the most common type of equity research reports in circulation.

They are normally produced by investment banks , typically for their clients to guide their investment decisions.

A sell-side analyst works for a brokerage firm or bank which manages individual clients and makes investment recommendations to them.

Sell-side analysts issue the often-heard recommendations of “buy”, “hold”, “neutral”, or “sell”.

These recommendations help clients make decisions to buy or sell stocks.

This is favourable for the brokerage firm as each time a client takes a decision to trade; the brokerage firm gets a commission on the transactions.

Click here to see some examples of sell-side reports

ii. Buy-Side reports

The ‘buy-side’ reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations.

A buy-side analyst generally works for a mutual fund or a pension fund company.

They perform research and make recommendations to the money managers of the fund that hires them.

Buy-side analysts will verify how promising an investment seems and how well it fits with the fund’s investment strategy.

These recommendations are made exclusively for the benefit of the fund that employs them and is not available to anyone outside the fund.

Within the buy/sell group, there are other types of reports like initiating coverage reports, standard reports, Issue reports, Investor notes, and sector reports.

iii. Initiating coverage reports

The initiating coverage reports are conducted on firms that the bank has begun following and are typically more comprehensive in nature.

Initiating coverage reports analyze a company’s historical financial information, order books, efficiency, SWOT, cash-flows, and future earning potential, basis which it estimates the future earnings of the company and its P/E multiples.

Click here to see some examples of initiating coverage reports

iv. Standard reports

After an initiating report is produced standard reports will follow for as long as the brokerage house continues to track the stock.

Stocks that are tracked are typically part of an index like the SENSEX or are amongst the top stocks in an industry as these are the stocks that investors care about and are traded in larger volumes.

v. Issue reports

These reports are issued when generally companies announce earnings each quarter (Quarterly earnings reports).

vi. Investor notes

These reports are published a few times in between for incremental information and news.

For example – investor conference companies hold a big M&A deal or a major new product announcement from a competitor.

These are usually short-run updates and are typically just quantitative in nature.

vii. Sector reports

A sector report is a document that evaluates a given industry and the companies involved in it.

It is often included as part of a business plan and typically seeks to establish how one company can gain an advantage in industry through detailed research on competition, products, and customers.

Click here to download the sector report

b. Contents of an equity research report

Now that we have understood the different types of equity research reports, let’s try to see the contents of an ER report.

An ER report should not be more than 10 to 15 pages long and should be very crisp and concise.

It should give the reader a clear understanding of the opinion of the analyst writing the report.

An ER report typically has the following contents:

1. Analyst opinion and summary

2. Key highlights of the company

3. A snapshot of the industry

4. Financial ratio analysis

5. Financial Modeling and Valuation analysis

6. Risk factors

7. Disclosure and rationale of rating

Usually, most of the equity research reports have this information; however, there is no hard and fast rule in which an ER report should be written.

We will study in detail (with examples) how to write each of these segments of an ER report in the forthcoming chapters.

c. Importance of Disclaimers in Analyst Reports

As every ER report is an investment document, and investors use it to make decisions for buying or selling securities based on it, it is important for the report to have certain disclaimers to show un-biases of the analyst writing the report.

Some typical disclaimers are as follows:

- Every ER report entirely reflects views and personal opinions of the analyst as on the date of publication

- The equity research analyst does not have an interest in the shares of the company

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report

Financial Analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

Equity research report writing process

Equity Research Report writing

After completing the fundamental analysis, financial statement analysis, ratio analysis, and valuation, the last part of the equity research process is writing equity research reports.

As an equity research analyst, you need to analyze the industry and the company first and then write the stock research report.

This step is paramount in your equity research analysis career .

This is important to write the equity research reports in such a way that your clients understand every word of it.

It’s also important to include relevant analysis that you’ve done in the report.

How to write a report

Let’s see each step of writing an equity research report in detail.

1. Company fundamental analysis

a) Macroeconomic Analysis

b) Checking public information of the company

c) Discussion/ interviews with company management

d) Prepare a 5-year cash flow model and earnings forecast model

e) Review your operational and financial assumptions

f) Assess management and competitive environment, buyers, suppliers, substitutes, porter 5-forces model that tells you the competitive advantage of the company.

2. Company valuation analysis

1. Use intrinsic valuation—Discounted Cash Flow(DCF) method

2. Relative valuation

3. sum-of-the-parts valuation method, wherever required.

Pointers for writing equity research reports

I’ve created a list of pointers purely based on my experience and observations and a bit of research about dos and don’ts while writing an equity research report.

1. A clear view of the company

Before writing the report, have a clear view of the company in terms of—Investment rationale, risk assessment, key growth drivers, cost drivers, and revenue drivers.

2. Recommendation/Rating

Clearly write the company’s name at the top of the report and mention your recommendation—buy, sell, hold.

You can also use the words—outperform, underperform, neutral or accumulate based on your valuation.

Have an image of an equity research report in your mind, and so you won’t miss these details.

Usually, there are templates available in your company and you need to write the report using these templates.

3. Target price

You need to mention the target price based on your valuation along with the recommendation.

4. Investment rationale

Write clearly your investment rationale. Why do you think the share price will go up/down?

5. Share price chart

Include a price chart of the stock that will show the last 52-weeks’ share price movement.

6.Business model

Mention the analysis of the company’s business model and how will it perform in the next 2-3 years.

7. Key ratio analysis

Include important ratio analysis of the company and 52-week high-low share price on a stock exchange.

Include market capitalization, Enterprise Value(EV), Earnings Before Interest Tax and Depreciation (EBITDA), EV/EBITDA, and dividend yield (%)

8. Product profile and segments

Analyze the company’s product profile, its various segments, and brands. Include current sales and forecasted revenue figures, cost, market size, company’s market share, competition, the company’s performance in domestic and other markets.

9. Economy-Industry-Company (E-I-C) Analysis

Cover the company’s fundamental analysis with supportive data.

10. Intrinsic and relative valuation

Perform DCF analysis and relative valuation. Relative valuation should be done with the company’s peers on the basis of Price-Earnings ratio (P/E), Price to Book ratio (P/B), Price to Sales (P/S), Return on Equity (ROE) and Return on Capital Employed (ROCE).

11. Reasoning for recommendation

Write proper reasoning for your recommendation. For example—Why buy the stock or why not to buy the stock. So, your reasoning has to be strong.

12. Unlock the value

Write what can unlock/increase/reduce the value of the company .

13. Legal matters

If the company is battling any case, write what could be its effects on the stock price.

14. Common industry points

While writing industry reports, write the points which are common for all players in the industry, for example, regulatory limitation, excise duty, oil prices, etc.

15. Covering all the areas in an equity research report

While writing the equity research report, assume that the reader is new to the company and he doesn’t have any idea about its business.

So, your report should include precise information about—product, financials, management, market, future plans of the company, growth estimates, and the risk factors of the company.

In short, as an equity research analyst, your equity analysis report writing process should be structured and you should follow the dos and don’ts mentioned in this post.

Sample equity research reports (PDFs):

The Walt Disney Company

If you have any queries, Speak Your Mind.

Key Takeaways

- Equity research report writing is a skill . You need to build this skill to go to the next level in your career . Top-notch careers in finance–equity research, investment banking , asset management, financial research, Knowledge Process Outsourcing (KPO) units value this skill in high regard.

- There are different types of research reports–sell-side, buy-side, initiating coverage, standard, issue, investor notes, and sector reports. As an analyst, you should know all these reports.

- Contents of an equity research report include Analyst opinion and summary, Key highlights of the company, A snapshot of the industry, Financial and ratio analysis, Valuation analysis, Risk factors, and Disclosure and rationale of rating. I’m going to cover all these sections in detail with examples in the coming chapters.

Now You Try It

I hope you can see the potential of equity research report writing skills for your career.

Yes, it takes hard work to create something great.

But with this skill, you already know ahead of time that your hard work is going to pay off.

I want you to give the skill a try and let me know how it works for you.

If you have a question or thought, leave a comment below and I’ll get right to it.

- Download BIWS Course sample videos here .

- Read Students’ Testimonials here .

Avadhut is the Founder of FinanceWalk. He enjoys writing on Finance Careers topics. Check our Financial Modeling Courses . Contact us for Career Coaching based on Your Inner GPS.

All FinanceWalk readers will get FREE $397 Bonus - FinanceWalk's Prime Membership.

If you want to build a long-term career in Financial Modeling, Investment Banking, Equity Research, and Private Equity, I’m confident these are the only courses you’ll need. Because Brian (BIWS) has created world-class online financial modeling training programs that will be with you FOREVER.

If you purchase BIWS courses through FinanceWalk links, I’ll give you a FREE Bonus of FinanceWalk's Prime Membership ($397 Value).

I see FinanceWalk's Prime Membership as a pretty perfect compliment to BIWS courses – BIWS helps you build financial modeling and investment banking skills and then I will help you build equity research and report writing skills.

To get the FREE $397 Bonus, please purchase ANY BIWS Course from the following link.

Breaking Into Wall Street Courses - Boost Your Financial Modeling and Investment Banking Career

To get your FREE Bonus, you must:

- Purchase the course through FinanceWalk links.

- Send me an email along with your full name and best email address to [email protected] so I can give you the Prime Bonus access.

Click Here to Check All BIWS Programs – Free $397 Bonus

Get new posts by email

Related post.

How To Do Equity Research: An Actionable Guide

ContentsWho Is This Guide for?What Is an Equity Research Reporta. Different types of equity reportsi. Sell-Side reportsii. Buy-Side reportsiii. Initiating coverage reportsiv. Standard reportsv. Issue reportsvi. Investor notesvii. Sector reportsb. Contents of an equity research reportc. Importance of Disclaimers in Analyst ReportsEquity research report writing processHow to write a report1. Company fundamental analysis2. Company valuation analysisPointers for writing equity research reports1. A clear view of the company2. Recommendation/Rating3. Target price4. Investment rationale5. Share price chart6.Business model7. Key ratio analysis8. Product profile ...

October 8, 2023

Equity Research Course: 10+ Lessons | Download XLS Free

September 22, 2023

Equity Research Interview Questions (Top 50 With Answers)

April 14, 2019

Equity Research Careers Guide – The Best Career Guide

January 24, 2019

How to Do Industry Analysis: Follow this 6-Step Process Model

Popular Post

$347 Free Bonus + Money-Back Guarantee

FinanceWalk

Reach out to us for a consultation. career coaching based on your inner gps., blog categories, navigations.

© 2007-2024 FinanceWalk - All rights reserved.

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

The Value of Equity Research

Equity research is an invaluable asset for anyone looking to stay up-to-date on market and industry trends. In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Get the guide

Introduction.

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

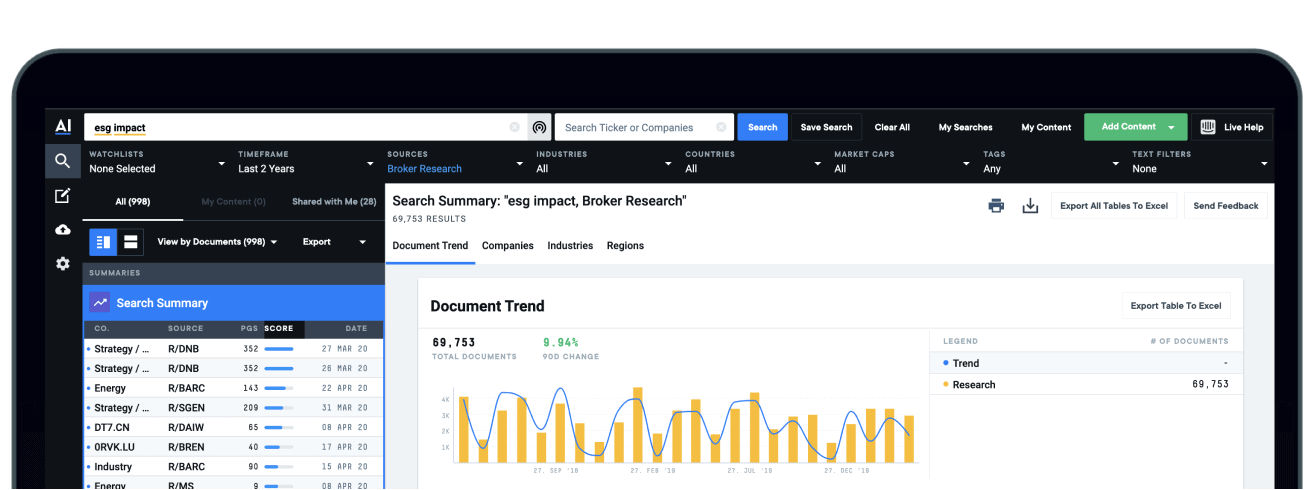

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

How Do Corporates Currently Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights?

Wall Street Insights is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Research Do You Get Access to with WSI?

Get access to the world’s leading equity research with Wall Street Insights. Download the e-book to learn more about equity research from Morgan Stanley, Barclays, Bernstein, Deutsche Bank, and more.

“We are delighted to partner with AlphaSense to expand access to Morgan Stanley’s global research platform,” says Simon Bound, Global Head of Research at Morgan Stanley. We have over 600 publishing analysts covering companies, industries, commodities, and macroeconomic developments across more than 50 countries. Morgan Stanley will bring corporates a unique perspective from our best in class analysts, a global platform, and a collaborative culture that enables us to unravel the most complex market and industry trends.”

How Can Companies Leverage Equity Research?

Discover how the world’s most innovative companies leverage Wall Street Insights to make critical business decisions every day. Download the e-book to read real case studies from a Corporate Development team and a Corporate Strategy team.

“AlphaSense’s corporate users are typically Corporate Strategy, Corporate Development, and Investor Relations professionals. Today, thousands of enterprises rely on equity research to power data-driven decision making. These teams leverage equity research reports to:”

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Ready to explore the world’s leading equity research

Trending Courses

Course Categories

Certification Programs

Free Courses

Investment Banking Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

By Dheeraj Vaidya, CFA, FRM

(ex. J.P. Morgan & CLSA Equity Analyst with 20+ years of training experience)

Equity Research Report Writing

Last Updated :

21 Aug, 2024

Blog Author :

Wallstreetmojo Team

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What is an Equity Research Report?

An Equity Research Report is a document prepared by Equity Research Analysts or Financial brokers. It focuses on a specific stock or industry sector, currency, commodity or fixed-income instrument, or even a geographic region or country. They contain recommendations for buying or selling that stock, including DCF modeling, relative valuations, etc.

Table of contents

Who are the Clients of the Brokerage Firm?

#1 - initiation report, #2 - sector report, #3 - strategic / economic reports, #4 - quarterly result reports, #5 - flash reports, golden rule, kiss - keep it simple silly, timely reports, the client is sophisticated and professional, charts and graphs, discuss the risks, 1. target price & stock data, 2. investment report summary, 3. estimates & valuation, case study 1 – general guidelines, case study 2 – using numbers, case study 3 - using tables, case study 4 - valuation discussion, case study 5 - risk discussions, using readability statistics - flesch-kincaid grade, recommended articles.

- The equity research report is a communication from a securities firm to its clients with a very specific purpose.

- It is intended to help an investor decide on the allocation of resources.

- All other purposes are secondary.

A Financial broker is an intermediary between the clients and the investment world. Clients are large investment funds like Pension Funds, Life Insurance Companies, Mutual Funds , FIIs, etc. Brokers are organizations like J.P.Morgan, Goldman Sachs, Credit Suisse, Nomura, Morgan Stanley, etc.

Although brokers facilitate the investments, they also provide investment advice. Sometimes this investment advice is paid for by the clients. However, in most cases, investment advice is provided for free. "Brokerage houses sell their Ideas." They charge commissions on each transaction executed through their trading division.

Clients receive more than 100+ research reports (ideas) emails from brokerage firms each day. Now think of this: more than 300+ brokerage firms are connected to these clients. Do you think the client has time to read all the research reports from head to toe?

We should understand that, at best, clients may spend not more than a minute or two minutes reading your research report. Your financial statement analysis report, if this is so, a 50+ page report would not make any sense. A novel-style research report is a trash!

Research reports must be crisp, to the point, and precise for the reasons above. We explore later the best practices for writing a research report.

This topic highlights key concepts and provides a broader understanding of the field. If you’re curious to explore these ideas more thoroughly, this Investment Banking Mastery Program (IBMP) offers a structured way to do so.

Explanation of Equity Research in Video

Types of equity research report.

- As the name suggests, these are the reports when the brokerage firms take coverage of the company. It means they started tracking the company for the first time.

- As this is the first research piece from the brokerage firm, it can typically be a detailed report and can vary from a 20-50 page report.

source: Religare research report

- Often, brokerage firms come up with Industry or Sector reports on the update.

- These reports, again, can be very exhaustive and helpful to clients.

- It provides deep insights into Industry dynamics, competitors, government regulations, and key forecasts.

source: Deutsche Bank research report

- These strategic or economic reports contain information on general macroeconomics, currency movements, commodities, etc.

- These reports are especially useful for portfolio managers to decide on country-specific fund flows.

- Also, research analysts use these strategic reports to incorporate any important correlation with their sectors.

source: Citibank research report

- These are 2-3 page reports highlighting critical result updates.

- These reports are generally smaller and contain only vital highlights of quarterly/annual results.

source: JPMorgan research report

- Flash news reports could be anything important that is worth communicating to clients.

- Sometimes, it could be just a quick email update or an alert.

- Events could be associated with important management changes, mergers, and acquisition , deal announcements, critical regulatory changes, etc.

Do's & Don'ts of Equity Research Report Writing

- Expectations from Dan Brown Novels are different; the climax comes at the last!

- Your Research Report is NOT anywhere close to novels, and it is diagonally opposite. Target price/recommendations come first!

- Readers hardly have 1-2 minutes to read your full report. They may not even scan till the 2nd page.

- Issuing the report in a timely fashion

- For Example, a result update report after 2-3 days may not be considered for reading

- Always use to the point and precise points

Equity Research Report Writing Standardization!

Keep the report short (maximum 20 pages) Use Headlines and comment flashes Make the format and layout as uncluttered as you can

Should be jargon-free - Avoid clichés, e.g., jack of all, the lion's share Be precise, clear, and concise Use short words like 'buy' rather than 'purchase.' Use of active voice, e.g., 'We forecast..' is better than 'it is forecasted to..'

Headings, Abbreviations Bullet points, Currencies Time, Dates Names and Titles, Figures Ranking, Upper Case, Lower Case, and Title Case

Use charts and graphs – an appropriate picture is worth a thousand words.

Put data in a table

It would help if you discussed the risk.

Anatomy of Equity Research Report - First Page

Having understood the types of equity research reports, let us now look at the anatomy of the Research Report. The first page is the most crucial page of the report. There are critical sections of the report –

- Recommended Target Price & Stock Data

- Investment Report Summary

- Estimates & Valuation

source: Merrill Lynch research report

- This section contains the target price and other financial data.

- The idea of this section is to get a quick glimpse of key variables like Market Capitalization ; Daily traded Volumes, Shares Outstanding, ROE, free float, etc.

- It primarily contains 2-3 most important aspects of the report.

- One discussion point is generally on the valuations and the risks associated with the company

- This section contains key estimates like Net Income, Profit, Dividends, etc. This section provides a quick glimpse of key forecasts to the clients.

- In addition, the report also contains valuation sections with key multiples like PE Ratio , Price to Book Value Ratio , EV/EBITDA , etc

Equity Research Report Writing - Case Studies

“1Q FY09 GDP rose 7.9% v/s 8.8% last quarter and 9.2% in 1QFY08. Growth was led by agriculture up 3%, industry up 6.9%, and services up 10%. GDP by expenditure indicates that while consumption growth at 7.9% was higher than trends in 1QFY08, investment growth decelerated to 9%- the first time below double-digits since 4QFY03. We expect these trends to continue in FY09.”

Some things to note in the above example 1QFY09 is used for representing 1st fiscal quarter of the year 2009 (writing in this style saves a lot of space for the report) Observe how the increase and decrease in growth rate v/s = versus We expect….

Heading - Solid 1Q Execution, But Orders Slow Heading should be to the point and catch!

Solid 1Q09 Execution Drive Surprise; Rec. PAT +70%; Buy We up L&T EPS by 3-4% over FY09-10E following Street-beating 1Q09 with Rec. PAT Rs4.9bn, +70%YoY +30% ahead of consensus. The company hiked guidance on FY09 sales growth to 30-35% v/s 30% earlier. However, the key worry was slowed order inflows (+24% v/s 30% guidance). An EPS CAGR of 36% (FY08-10E) & creation of vehicles of future growth through high-end power equipment, shipyard, and big project wins at IDPL, railways, defense, Nuke & Aerospace domains are potential triggers. We cut PO to Rs3450 (3950) to factor in market/stock de-rating, higher risk-free rate (9% v/s 8%) for Infra SPVs, and discount to realty SPV.

Case Analysis Always subordinate numerical information to a non-numerical idea. Y-o-Y – used year over year "+70%" used to indicate a growth of 70% CAGR = cumulative average growth rate The language used is very professional.

Readability statistics can provide significant inputs regarding the sophistication of your research report. Below is a quick summary of using Readability Statistics –

- In Word, click on the Windows button in the top left corner of your screen,

- Then click on Word Options; when you are in the Word Options pop-up, click on Proofing on the left;

- When correcting spelling and grammar in Word, make sure that Show readability statistics is checked.

Now, run spelling and grammar checks through your document. At the very end of the process, the Readability Statistics will pop up.

This score relates to US school grade levels. A score of 8.0, for instance, means that your writing is geared toward an eighth-grade reading level.

- For those not based in the US, grade levels relate to actual age as follows. 1st Grade 6–7 2nd Grade 7–8 3rd Grade 8–9 4th Grade 9–10 5th Grade 10–11 6th Grade 11–12 7th Grade 12–13 8th Grade 13–14 High school 9th Grade (Freshman) 14-15 10th Grade (Sophomore) 15-16 11th Grade (Junior) 16-17 12th Grade (Senior) 17–18

So a Flesch-Kincaid Grade Level score of 10 means that you are aiming roughly at 'an educated reader' of about 15 years old.

It would be best to remember that your research report is for sophisticated /educated users, and it should contain 12 and above grades.

This article has been a guide to Equity Research Report Writing. If you learned something new or enjoyed the post, please comment below. Let me know what you think. Many thanks, and take care. Happy Learning!

- Equity Research vs. Private equity Compare

- Equity Research vs. Sales & Trading differences

- Equity Research vs. Investment Banking

- Search Search Please fill out this field.

- Research in Bull & Bear Markets

How Equity Research Is Changing

- Who Pays for Research?

- The Role of Fee-Based Research

The Bottom Line

The changing role of equity research.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

The role of equity research is to provide information to the market. A lack of information creates inefficiencies that result in stocks being misrepresented (whether over or undervalued). Analysts use their expertise and spend a lot of time analyzing a stock, its industry, and its peer group to provide earnings and valuation estimates. Research is valuable because it fills information gaps so that each individual investor does not need to analyze every stock. This division of labor makes the market more efficient.

The title of this article is perhaps a bit misleading, because the role of equity research really hasn't changed since the first U.S. stock trade occurred under the buttonwood tree on Manhattan Island. What has changed is the economic and trading environments (e.g. the character of bull and bear markets) that influence research.

Key Takeaways

- Equity research is a key piece of Wall Street analysis, used by investors large and small to make better-informed investment decisions in the stock market.

- Often research is funded by institutional investors on a fee-basis or using soft dollars.

- Depending on whether the market is in a bull or bear mode, equity research has begun to shift its lens of analysis and the types of reports issued.

Research in Bull and Bear Markets

In every bull market, some excesses become apparent only in the bear market that follows. Whether it is dotcoms or organic foods, each age has its mania that distorts the normal functioning of the market. In a rush to make money, rationality is the first casualty. Investors rush to jump on the bandwagon and the market over-allocates capital to the "hot" sector(s). This herd mentality is the reason why bull markets have funded so many "me-too" ideas throughout history.

Research is a function of the market and is influenced by these swings. In a bull market, investment bankers , the media and investors pressure analysts to focus on the hot sectors. Some analysts morph into promoters as they ride the market. Those analysts that remain, rational practitioners, are ignored, and their research reports go unread.

Seeking to blame someone for investment losses is a normal event in bear markets. It happened in the 1930s, 1970s, during the dot com crash and the financial crisis of 2008, too. Some of the criticisms are deserved, but generally, the need to provide information about companies has not changed.

To discuss the role of research in today's market , we need to differentiate between Wall Street research and other research. The major brokerages provide Wall Street research—typically sell-side firms—both on and off Wall Street. Other research is produced by independent research firms and small boutique brokerage firms.

This differentiation is important. First, Wall Street research has become focused on large-cap , very liquid stocks, and ignores the majority of publicly traded stocks. To remain profitable, Wall Street firms have focused on big-cap stocks to generate highly lucrative investment banking deals and trade profits, but also face the daunting task of cutting costs.

Those companies that are likely to provide the research firms with sizable investment banking deals are the stocks that are determined worthy of being followed by the market. The stock's long-term investment potential is often secondary.

Other research is filling the information gap created by Wall Street. Independent research firms and boutique brokerage firms are providing research on the stocks that have been orphaned by Wall Street. This means that independent research firms are becoming a primary source of information on the majority of stocks, but investors are reluctant to pay for research because they don't know what they are paying for until well after the purchase. Unfortunately, not all research is worth buying, as the information can be inaccurate and misleading.

These days there is a great deal of research that is provided for free to clients via email. Even at essentially zero cost to the investor, a large majority of the research goes unread.

Who Pays for Research? Big Investors Do!

The ironic thing is that while research has proven to be valuable, individual investors do not seem to want to pay for it. This may be because, under the traditional system, brokerage houses provided research to gain and keep clients. Investors just had to ask their brokers for a report and received it at no charge. What seems to have gone unnoticed is that the investor commissions paid for that research.

A good indicator of the value of research is the amount institutional investors are willing to pay for it. Institutional investors typically hire their own analysts to gain a competitive edge over other investors. Although spending on equity research analysts has significantly declined in recent years, institutions may also pay for the sell-side research they receive (either with dollars or by giving the supplying brokerage firm trades to execute).

European regulations that went into effect in 2018, known as MiFID II , require asset managers to fund external research from their own profit and loss account (P&L) or through research payments that are tracked with clear audit trails. This will lead to billing clients for research and trading separately.

The Role of Fee-Based Research

Fee-based research increases market efficiency and bridges the gap between investors who want research (without paying) and companies who realize that Wall Street is not likely to provide research on their stock. This research provides information to the widest possible audience at no charge to the reader because the subject company has funded the research.

It is important to differentiate between objective fee-based research and research that is promotional. Objective fee-based research is similar to the role of your doctor. You pay a doctor not to tell you that you feel good, but to give you their professional and truthful opinion of your condition.

Legitimate fee-based research is a professional and objective analysis and opinion of a company's investment potential. Promotional research is short on analysis and full of hype. One example of this is the email reports and misleading social media posts about the penny stocks that will supposedly triple in a short time.

Legitimate fee-based research firms have the following characteristics:

- They provide analytical, not promotional services.

- They are paid a set annual fee in cash; they do not accept any form of equity, which may cause conflicts of interest .

- They provide full and clear disclosure of the relationship between the company and the research firm so investors can evaluate objectivity.

Companies that engage a legitimate fee-based research firm to analyze their stock are trying to get information to investors and improve market efficiency.

Such a company is making the following important statements:

- It believes its shares are undervalued because investors are not aware of the company.

- It is aware that Wall Street is no longer an option.

- It believes that its investment potential can withstand objective analysis.

The National Investor Relations Institute (NIRI) was probably the first group to recognize the need for fee-based research. In January 2020, NIRI issued a letter emphasizing the need for small-cap companies to find alternatives to Wall Street research to get their information to investors.

The reputation and credibility of a company and research firm depends on the efforts they make to inform investors. A company does not want to be tarnished by being associated with unreliable or misleading research. Similarly, a research firm will only want to analyze companies that have strong fundamentals and long-term investment potential. Fee-based research continues to provide a professional and objective analysis of a company's investment potential, although the market for its services remains challenged in the current business environment.

CFA Institute. " MiFID II Equity Research Costs Survey ."

National Investor Relations Institute (NIRI). " NIRI Proposes Guidance on Company-sponsored Research ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1223455275-0224651b7a6b405dab8b1434e1d36085.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

VIDEO