- Search Search Please fill out this field.

- Alternative Investments

- Private Equity & VC

How to Start Your Own Private Equity Fund

:max_bytes(150000):strip_icc():format(webp)/picture-53668-1413912494-5bfc2a95c9e77c005143c916.png)

Private equity firms have been a historically successful asset class and the field continues to grow as more would-be portfolio managers join the industry. Many investment bankers have made the switch from public to private equity because the latter has significantly outperformed the Standard & Poor's 500 Index over the last few decades, fueling greater demand for private equity funds from institutional and individual accredited investors . As demand continues to swell for alternative investments in the private equity space, new managers will need to emerge and provide investors with new opportunities to generate alpha.

Key Takeaways

- Private equity firms are growing thanks to their outperformance of the S&P 500.

- Starting a private equity fund means laying out a strategy, which means picking which sectors to target.

- A business plan and setting up the operations are also key steps, as well as picking a business structure and establishing a fee structure.

- Arguably the toughest step is raising capital, where fund managers will be expected to contribute 1% to 3% of the fund’s capital.

Today's many successful private equity firms include Blackstone Group, Apollo Global Management, TPG Capital, Goldman Sachs Capital Partners, and the Carlyle Group. However, most firms are small to midsize shops and can range from just two employees to several hundred workers. Here are several steps managers should follow to launch a private equity fund .

Define the Business Strategy

First, outline your business strategy and differentiate your financial plan from those of competitors and benchmarks. Establishing a business strategy requires significant research into a defined market or individual sector. Some funds focus on energy development, while others may focus on early-stage biotech companies. Ultimately, investors want to know more about your fund's goals.

As you articulate your investment strategy , consider whether you will have a geographic focus. Will the fund focus on one region of the United States? Will it focus on an industry in a certain country? Or will it emphasize a specific strategy in similar emerging markets? Meanwhile, there are several business focuses you could adopt. Will your fund aim to improve your portfolio companies' operational or strategic focus, or will this center entirely on cleaning up their balance sheets ?

Remember, private equity typically hinges on investment in companies that are not traded on the public market. It's critical that you determine the purpose of each investment. For example, is the aim of the investment to grow capital for mergers and acquisitions activity? Or is the goal to raise capital that will allow existing owners to sell their positions in the firm?

Business Plan, Operations Setup

The second step is to write a business plan, which calculates cash flow expectations, establishes your private equity fund's timeline, including the period to raise capital and exit from portfolio investments . Each fund typically has a life of 10 years, although ultimately timelines are up to the manager's discretion. A sound business plan contains a strategy on how the fund will grow over time, a marketing plan to target future investors, and an executive summary, which ties all of these sections and goals together.

Following the establishment of the business plan, set up an external team of consultants that includes independent accountants, attorneys and industry consultants who can provide insight into the industries of the companies in your portfolio. It's also wise to establish an advisory board and explore disaster recovery strategies in case of cyberattacks, steep market downturns, or other portfolio-related threats to the individual fund.

Another important step is to establish a firm and fund name. Additionally, the manager must decide on the roles and titles of the firm's leaders, such as the role of partner or portfolio manager. From there, establish the management team, including the CEO, CFO, chief information security officer, and chief compliance officer . First-time managers are more likely to raise more money if they are part of a team that spins out of a previously successful firm.

On the back end, it's essential to establish in-house operations. These tasks include the rent or purchase office space, furniture, technology requirements, and hiring staff. There are several things to consider when hiring staff, such as profit-sharing programs , bonus structures, compensation protocols, health insurance plans, and retirement plans.

Establish the Investment Vehicle

After early operations are in order, establish the fund’s legal structure. In the U.S., a fund typically assumes the structure of a limited partnership or a limited liability firm. As a founder of the fund, you will be a general partner, meaning that you will have the right to decide the investments that compose the fund.

Your investors will be limited partners who don't have the right to decide which companies are part of your fund. Limited partners are only accountable for losses tied to their individual investment, while general partners handle any additional losses within the fund and liabilities to the broader market.

Ultimately, your lawyer will draft a private placement memorandum and any other operating agreements such as a limited partnership agreement or articles of association .

Determine a Fee Structure

The fund manager should determine provisions related to management fees, carried interest and any hurdle rate for performance. Typically, private equity managers receive an annual management fee of 2% of committed capital from investors. So, for every $10 million the fundraises from investors, the manager will collect $200,000 in management fees annually. However, fund managers with less experience may receive a smaller management fee to attract new capital.

Carried interest is commonly set at 20% above an expected return level. Should the hurdle rate be 5% for the fund, you and your investors would split returns at a rate of 20 to 80. During this period, it is also important to establish compliance, risk and valuation guidelines for the fund.

Raise Capital

Next, you will want to have your offering memorandum, subscription agreement , partnership terms, custodial agreement , and due diligence questionnaires prepared. Also, marketing material will be needed prior to the process of raising capital. New managers will also want to ensure that they have obtained a proper severance letter from previous employers. A severance letter is important because employees require permission to boast about their previous experience and track record.

All of this leads ultimately leads you to the biggest challenge of starting a private equity fund, which is convincing others to invest in your fund. Firstly, prepare to invest your own fund. Fund managers who had had success during their careers will likely be expected to provide at least 2% to 3% of their money to the fund's total capital commitments . New managers with less capital can likely succeed with a commitment of 1% to 2% for their first fund.

In addition to your investment track record and investment strategy, your marketing strategy will be central to raising capital. Due to regulations on who can invest and the unregistered nature of private equity investments, the government says that only institutional investors and accredited investors can provide capital to these funds.

Institutional investors include insurance firms, sovereign wealth funds , financial institutions, pension programs , and university endowments. Accredited investors are limited to individuals who meet a specified annual income threshold for two years or maintain a net worth (less the value of their primary residence) of $1 million or more. Additional criteria for other groups that represent accredited investors are discussed in the Securities Act of 1933 .

Once a private equity fund has been established, portfolio managers have the capacity to begin building their portfolio. At this point, managers will start to select the companies and assets that fit their investment strategy.

The Bottom Line

Private equity investments have outperformed the broader U.S. markets over the last few decades. That has generated increased demand from investors seeking new ways to generate superior returns . The above steps can be used as a roadmap for establishing a successful fund.

Bain & Company. " Public vs. Private Equity Returns: Is PE Losing Its Advantage? "

United States Office of Government Ethics. " Capital Commitment ."

U.S. Securities and Exchange Commission. "' Accredited Investor' Net Worth Standard ."

:max_bytes(150000):strip_icc():format(webp)/stocks-lrg-3-5bfc2b1d46e0fb005144ca11.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Sample Business Plans

Investment Company Business Plan

The possibility for substantial financial gains is one of the main advantages of an investment company. As the company expands and gains customers, it has the potential to generate large fees and commissions based on investment portfolios.

Are you looking for the same rewards? Then go on with planning everything first.

Need help writing a business plan for your investment company? You’re at the right place. Our investment company business plan template will help you get started.

Free Business Plan Template

Download our free investment company business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your Business: Start your executive summary by briefly introducing your business to your readers.This section may include the name of your investment company, its location, when it was founded, the type of investment company (E.g., mutual fund companies, hedge funds, venture capital firms), etc.

- Market Opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Products and Services: Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.For instance, you may include investment management, portfolio diversification, or tax planning as services and mention customized investment solutions as your USP.

- Marketing & Sales Strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial Highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to Action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

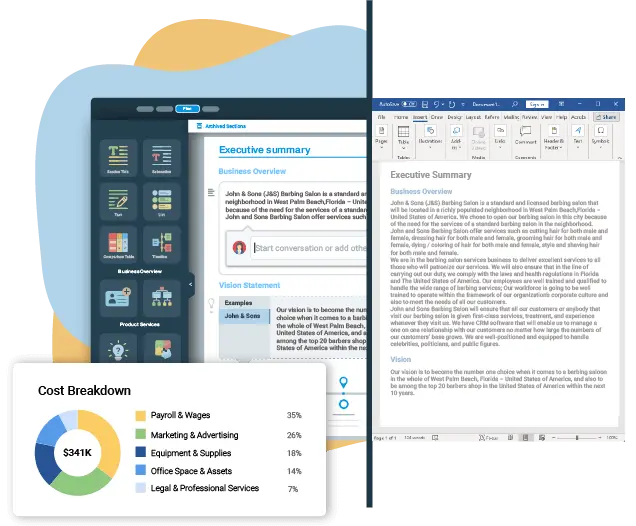

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the names of your investment company’s founders or owners. Describe what shares they own and their responsibilities for efficiently managing the business. Mission Statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business History: If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future Goals: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.For instance, individual individuals, institutions & corporations, etc can be the target market for investment companies.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.The global investment market grew to around $3837 billion this year from around $3532 billion in 2022 at a CAGR of 8.6%.

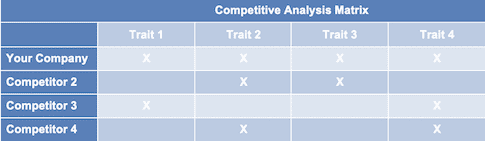

- Competitive Analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your investment company services from them. Point out how you have a competitive edge in the market.

- Market Trends: Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.For instance, there is growing popularity for passive income; explain how you plan on dealing with this potential growth opportunity.

- Regulatory Environment: List regulations and licensing requirements that may affect your investment company, such as securities laws, anti-money laundering laws, KYC, market regulations, etc.

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

- Investment advisory services: Investment advisory services might include professional advice on asset allocation, investment strategies, and portfolio construction. Both discretionary and non-discretionary investment advisory services available or not should be mentioned.

- Additional Services: Mention if your investment company offers any additional services. You may include services like retirement planning, estate planning & wealth transfer, business succession planning, etc.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique Selling Proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.For example, customized investment solutions, expertise, or innovative investment strategies could be some of the great USPs for an investment company.

- Pricing Strategy: Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers.

- Marketing Strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, Google ads, SEO, email marketing, content marketing, etc.

- Sales Strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with other businesses, consultative selling, etc.

- Customer Retention: Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, discounts on annual membership, personalized service, etc.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & Training: Mention your business’s staffing requirements, including the number of employees, consultants, or data analyst needed. Include their qualifications, the training required, and the duties they will perform.

- Operational Process: Outline the processes and procedures you will use to run your investment company. Your operational processes may include portfolio management, client onboarding, investment research & analysis, trade execution & settlement, etc.

- Equipment & Software: Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founders/CEO: Mention the founders and CEO of your investment company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities.It should include, key executives(e.g. COO, CMO), senior management, and other department managers (e.g. operations manager, portfolio manager, compliance manager) involved in the investment company business operations, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation Plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/Consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

8. Financial Plan

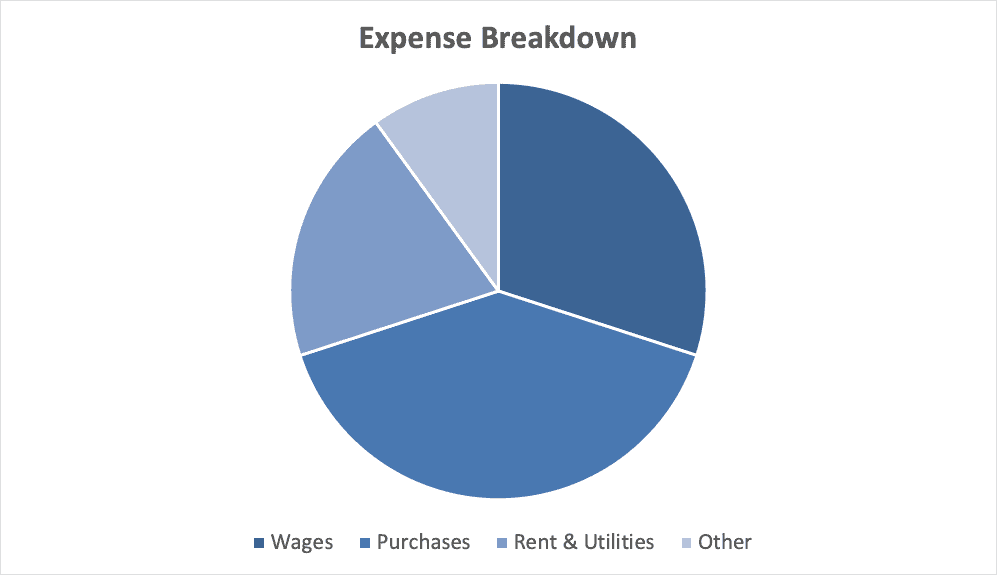

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement . Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance Sheet: Create a projected balance sheet documenting your investment company’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing Needs: Calculate costs associated with starting an investment company, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write a Business Plan For Investors

Frequently Asked Questions

Why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

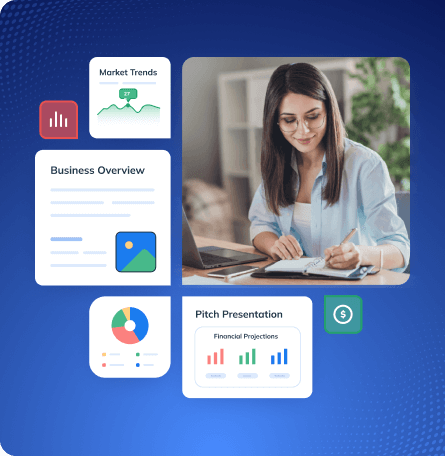

How to Write a Convincing Business Plan for Investors

Noah Parsons

9 min. read

Updated August 1, 2024

Raising money for your business is a major effort. You need lists of investors to reach out to and you need to be prepared for your investor meetings to increase your chances of getting funded . You need to practice your pitch and be ready to intelligently answer any number of questions about your business. A key to making this entire process much easier is to invest a little time and write a business plan . It’s true — not all investors will ask to see your business plan.

But putting together a business plan will ensure that you’ve considered every aspect of your business and are ready to answer any questions that come up during the fundraising process.

- Why do investors want to see a business plan?

The business plan document itself isn’t what’s important to investors. It’s the knowledge that you’ve generated by going through the process that’s important. Having a business plan shows that you’ve done the homework of thinking through how your business will work and what goals you’re trying to achieve.

When you put together a business plan, you have to spend time thinking about things like your target market , your sales, and marketing strategy , the problem you solve for your customers, and who your key competitors are . A business plan provides the structure for thinking through these things and documents your answers so you’re prepared for the inevitable questions investors will ask about your business.

Even if investors never ask to see your business plan, the work you’ve done to prepare it will ensure that you can intelligently answer the questions you’ll get. And, if an investor does ask for your business plan, then you’re prepared and ready to hand it over. After all, nothing could be worse than arriving at an investor meeting and then getting a request for a business plan and not having one ready.

Beyond understanding your business strategy, investors will also want to understand your financial forecasts. They want to know how your business will function from a financial standpoint — what is typically called your “ business model .” They’ll also want to know what it will take for your business to be profitable and where you anticipate spending money to grow the business. A complete financial plan is part of any business plan, so investing a little time here will serve you well.

- What do investors want to see in a business plan?

There’s no such thing as a perfect business plan and investors know this. After all, they’ve spent years, and often decades, hearing business pitches, reading business plans, investing in companies, and watching them both succeed and fail. As entrepreneur and investor Steve Blank likes to say, “No business plan survives first contact with a customer.”

If this is true, then why bother writing a business plan at all? What’s the value of planning and why do investors want them if they know the plan will shortly be outdated?

The secret is that it’s the planning process, not the final plan, that’s valuable. Investors want to know that you’ve thought about your idea, documented your assumptions, and are on track to validate those assumptions so that you can remove risk from your business.

So what do investors want to see in your business plan? Beyond the typical sections , here are the most important things that investors want to see in your plan.

A vision for the future

Investors, particularly those investing in early-stage startups, want to understand your vision . Where do you see your company going in the future? Who will your customers be and what problems will you solve for them? Your vision may take years to execute — and it’s likely that the vision will change and evolve over time — but investors want to know that you’re thinking beyond tomorrow and into the future.

Product/market fit and traction

Investors want more than just an idea. They want evidence that you are solving a problem for customers. Your customers have to want what you are selling for you to build a successful business and your business plan needs to describe the evidence that you’ve found that proves that you’ll be able to sell your products and services to customers. If you have “traction” in the form of early sales and customers, that’s even better.

Funding needed and use of funds

When you’re pitching investors, you need to know how much you’re asking for. Your financial forecast should help you figure this out. You’ll want to raise enough money to cover planned expenses and cash flow requirements plus some additional funding as a safety net. In addition, you’ll want to specify exactly how you plan on using your investment . In a business plan, this section is often called “sources and uses of investment.”

A strong management team

A good idea is really only a small part of the equation for a successful business. In fact, lots of people have good business ideas — it’s the people that can execute well that generally succeed. Investors will pay a lot of attention to the section of your plan where you talk about your management team because they want to know that you can transform your idea into a successful business. If you have gaps and still need to hire key employees, that’s OK. Communicating that you understand what your needs are is the most important thing.

An exit strategy

When investors give you money to start and grow your business, they are looking to eventually make a return on their investment. This could happen by eventually selling your business to a larger company or even by going public. One way or another, investors will want to know your thoughts about an eventual exit strategy for your business.

- What documents do investors want to see?

Even if investors never ask for a detailed business plan, your business planning process should produce a few key documents that investors will want to see. Here’s what you need to be prepared to pitch investors:

Cover letter

These days, a lot of fundraising outreach is done over email and you’ll need a concise cover letter that sparks investor interest. Your cover letter needs to be very brief, but describe the problem you’re solving for your target market.

Great cover letters are sometimes in a “story” format that hooks readers with a real-world, relatable example of the problems your customers face and how our product or service The goal of the cover letter isn’t to explain every aspect of your business. It’s just to spark interest and get a meeting with an investor where you’ll have more time to actually pitch your business. Keep your cover letter brief, engaging, and to the point.

If you get an investor meeting, you’ll almost certainly need a pitch deck to present your idea in more detail and showcase your business idea. Your pitch deck will cover the problem you’re solving, your solution, your target market, and key market trends.

Further Reading: What to include in your pitch deck

Executive summary and/or one-page plan

You might not get a meeting right away. Your cover letter may generate a request for additional information and this is where a solid executive summary or one-page business plan comes in handy. This document, while still short, is more detailed than your cover letter and explains a bit more about your business in a page or two.

Read more about what goes into a great executive summary and how to build a lone-page business plan.

Financial forecasts

Investors will inevitably want to see your financial forecasts. You’ll need a sales forecast, expense budget , cash flow forecast , profit and loss, and balance sheet . If you have historical results, you should plan on sharing those too as well as any other key metrics about your business. Investors will always look deep under the hood of your business, so be prepared to share all the details of how your business will work from a financial perspective.

- What to include in your investor business plan

When you put together a detailed business plan for investors, you’ll follow a fairly standard format. To get started, I recommend you download our free business plan template . It’s lender-approved and, of course, can be customized to fit your business needs.

Remember: your business plan isn’t about the plan document that you create — it’s about the planning process that helps you think through and develop your business strategy. Here’s what most investor business plans will include:

Executive Summary

Usually written last, your executive summary is an overview of your business. As I mentioned earlier, you might use the executive summary as a stand-alone document to provide investors more detail about your business in a concise form. Read our guide on executive summaries here .

Opportunity

The opportunity section of your plan covers the problem you are solving, what your solution is, and highlights any data you have to prove that people will spend money on what you’re offering. If you have customer validation in any form, this is where you highlight that information.

Market Analysis

Describe what your target market is and key trends that are occurring in this market . Is the market growing? Are buying patterns changing? How is your business positioned to take advantage of these changes? Be sure to spend some time discussing your competition and how your target market solves their problems today and how your solution is superior.

Marketing & Sales Plan

Most businesses need to figure out how to get the word out and attract customers. Your business plan should include a marketing plan that describes how you’re going to reach your target market and any key marketing initiatives that you’re going to undertake. You should also spend time describing your sales plan, especially if your sales process takes time to close customers.

Milestones / Roadmap

Outline key milestones you hope to achieve and when you plan on achieving them. This section should cover key dates for product development, key partnerships you need to create, and any other important goals you plan on achieving.

Company & Management

Here’s where you describe the nuts and bolts of your business. How is your organization structured? Who is on your team and what are their backgrounds? Are there any important positions that you still need to recruit for?

Financial Plan

As I mentioned, you’ll need to create a profit and loss, cash flow, and balance sheet forecast. Your financial plan should be optimistic, yet realistic. This is a tough balance and your forecast is certain to be wrong, but you need to document your assumptions and plans for the business.

Finally, you can include an appendix for any key additional information you want to share. Product diagrams, additional details on how you deliver your service, or additional research can all be included.

- What comes next?

Writing a business plan for investors is really about preparing you to pitch your business . It’s quite likely that you’ll never get asked for the actual business plan document. But, the process will prepare you better than anything else to answer any questions investors may have.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

Related Articles

1 Min. Read

5 Tips on Negotiating an Investment Deal

8 Min. Read

What Do Investors Really Want From a Business?

3 Min. Read

10 Good Reasons Not to Seek Investors for Funding

9 Min. Read

How to Handle Business Rejection by Investors in 10 Steps

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Investment Company Business Plan?

A business plan provides a snapshot of your investment company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Investment Company

If you’re looking to start an investment company, or grow your existing investment company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your investment company in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Investment Companies

With regards to funding, the main sources of funding for an investment company are bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Investors, grants, personal investments, and bank loans are the most common funding paths for investment companies.

Finish Your Business Plan Today!

How to write a business plan for an investment company.

If you want to start an investment company or expand your current one, you need a business plan. Below we detail what you should include in each section of your own business plan:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status. For example, are you a startup, do you have an investment company that you would like to grow, or are you operating investment companies in multiple markets?

Next, provide an overview of each of the subsequent sections of your business plan. For example, give a brief overview of the investment company industry. Discuss the type of investment company you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of investment company you are operating.

For example, you might operate one of the following types of investment companies:

- Closed-End Funds Investment Company : this type of investment company issues a fixed number of shares through a single IPO to raise capital for its initial investments.

- Mutual Funds (Open-End Funds) Investment Company: this type of investment company is a diversified portfolio of pooled investor money that can issue an unlimited number of shares.

- Unit Investment Trusts (UITs) Investment Company: this type of investment company offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time.

In addition to explaining the type of investment company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of investments made, number of client positive reviews, reaching X amount of clients invested for, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the investment industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the investment industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your business plan:

- How big is the investment industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your investment company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: companies or employees in specific industries, couples with double income, families with kids, small business owners, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of investment company you operate. Clearly, couples with families and double income would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Investment Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other investment companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes robo investors and advisors, company 401Ks, etc. You need to mention such competition as well.

With regards to direct competition, you want to describe the other investment companies with which you compete. Most likely, your direct competitors will be investment companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of clients do they serve?

- What type of investment company are they and what certifications do they have?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better investment strategies?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an investment company, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to an investment company, will you provide insurance products, website and app accessibility, quarterly or annual investment reviews, and any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your company. Document your location and mention how the location will impact your success. For example, is your investment company located in a busy retail district, a business district, a standalone office, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your investment company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Commercials and billboards

- Reaching out to websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your investment company, including researching the stock market, keeping abreast of all investment industry knowledge, updating clients on any new activity, answering client phone calls and emails, networking to attract potential new clients.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to land your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your investment business to a new city.

Management Team

To demonstrate your investment company’s ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing investment companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an investment company or successfully advised clients who have achieved a successful net worth.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you take on one new client at a time or multiple new clients? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your investment company, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an investment company:

- Cost of investor licensing..

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or list of clients that you have acquired.

Putting together a business plan for your investment company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the investment industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful investment company.

Don’t you wish there was a faster, easier way to finish your Investment Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to hire someone to write a business plan for you from Growthink’s team.

Other Helpful Business Plan Articles & Templates

Private Equity Firm Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Financial Services

Are you about starting a private equity firm ? If YES, here is a complete sample private equity firm business plan template & feasibility report you can use for FREE .

If you are an investment banker or you have been able to grow through the ladder of the business world with a niche in investment, then you should consider starting your own private equity firm. Private equity firms make use of their available funds or raised funds from investors with the aim of investing in underperforming companies with potentials, with the aim of repositioning the companies.

Starting this type of business does not only require huge capital base but also relevant experience in the industry. If you have not cut your teeth in the industry, you are likely not going to get investors to commit their cash in your business. Investors only invest their hard earned money with those who have track records in investment.

Suggested for You

- Financial Coaching Business Plan [Sample Template]

- ATM Business Plan [Sample Template]

- Mobile Money Transfer Agency Business Plan [Sample Template]

- Investment Bank Business Plan [Sample Template]

- Credit Card Processing Business Plan [Sample Template]

If you have decided to start a private equity firm, then you should must make sure that you carry out thorough feasibility studies and market survey.

Business plan is yet another very important business document that you should not take for granted when launching your own business. Below is a sample private equity firm business plan template that will help you to successfully write your own.

A Sample Private Equity Firm Business Plan Template

1. industry overview.

The Private Equity, Hedge Funds & Investment Vehicles industry is made up of Private equity funds, hedge funds, closed-end funds and unit investment trusts. This firms basically raise capital to invest in various asset classes. Industry assets have become increasingly integral to institutional investors’ portfolios and the larger asset-management market.

Institutional investors are individuals or organizations that trade securities in such substantial volumes that they qualify for lower commissions and fewer protective regulations since they are assumed to be knowledgeable enough to protect themselves.

Increasing demand from institutional investors has contributed to the surge in the industry’s assets under management (AUM) and revenue over the past five years.

It is a fact that the Private Equity, Hedge Funds & Investment Vehicles industry is growing faster than most industries in the financial services sector not only in the united states but across the global market. Industry value added (IVA), a measure of the industry’s contribution to the overall economy, is projected to increase at a 6.9 percent annualized rate over the next 10 years.

Without a doubt, the Private Equity, Hedge Funds & Investment Vehicles industry is a very large and thriving not only in the developed nations, but also in developing and under developing countries of the world. Statistics has it that the Private Equity, Hedge Funds & Investment Vehicles industry in the United States of America is worth $229 billion, with an estimated growth rate of 7.3 percent between 2013 and 2018.

There are about 20,647 registered and licensed private equity firms in the United States and they are responsible for employing about 80,298 people. It is important to state that there is no company with a dominant market share in this industry.

A recent report published by IBISWorld shows that over the past five years, the Private Equity, Hedge Funds & Investment Vehicles in the US industry has grown by 7.2 percent to reach revenue of $229bn in 2018. In the same time frame, the number of businesses has grown by 2.4 percent and the number of employees has grown by 8.8 percent.

The report also shows that an increase in the regulation and taxation of private equity, hedge funds or other investment vehicles may raise their compliance costs, reduce their returns and limit the number of investment activities companies can undertake.

Regulation for the Investment Management industries is expected to increase in 2018, posing a potential threat to the industry.

So also, institutional investors such as retirement and pension plans, are the largest contributors to alternative investment vehicles, such as private equity and hedge funds due to their low liquidity and high-return needs. As pension plans increase their asset levels to fund future retirement benefits, they will invest in private equity and hedge funds and boost industry revenue through asset-management fees.

Demand from retirement and pension plans is expected to increase in 2018, representing a potential opportunity for the industry. The truth is that with the rate at which private equity firms and similar businesses are growing in the United States, it means it is a business that is worth starting most especially if you have the expertise and capital.

2. Executive Summary

Thomas McKenzie® Private Equity Firm, Inc. is a registered, licensed and accredited private equity firm that will be based in Medford – Oregon.

We are well equipped to operate in the Private Equity, Hedge Funds & Investment Vehicles industry and carry out key functions that revolve around raising capital to invest in various asset classes in the United States of America. We are aware that to run a standard private equity firm can be demanding which is why we are well trained, certified and fortified.

Thomas McKenzie® Private Equity Firm, Inc. is a client – focused and result driven private equity firm that provides broad – based services. We will offer trusted and profitable services to all our clients. We will ensure that we work hard to meet and surpass our clients’ expectations whenever they invest their funds with us.

At Thomas McKenzie® Private Equity Firm, Inc., our client’s best interest would always come first, and everything we do is guided by our values and professional ethics. We will ensure that we hire professionals who are well experienced in this line of business with good track record of return on investments.

Thomas McKenzie® Private Equity Firm, Inc. will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible.

We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely.

Our plan is to position the business to become one of the leading brands in the Private Equity, Hedge Funds & Investment Vehicles industry in the whole of Medford, and also to be amongst the top 20 private equity firms in the United States of America within the first 10 years of operation.

This might look too tall a dream but we are optimistic that this will surely be realized because we have done our research and feasibility studies and we are confident that Oregon is the right place to launch our business before expanding to other cities in the United States of America.

Thomas McKenzie® Private Equity Firm, Inc. is owned and managed by Thomas McKenzie. Thomas McKenzie has a Degree in Business Administration from Northern Michigan University; MBA in Economics from Columbia Business School. Investing is a family trait that Thomas McKenzie inherited from his father, a stockbroker and U.S. congressman.

At the age of 13, Thomas McKenzie made his first investment, and by the age of 13 he was selling horse racing tip sheets and operating a paper delivery service. Thomas McKenzie has over 18 years’ experience working at various capacities in the Private Equity, Hedge Funds & Investment Vehicles industry in the United States of America.

3. Our Products and Services

Thomas McKenzie® Private Equity Firm, Inc. is going to offer varieties of services within the Private Equity, Hedge Funds & Investment Vehicles industry in the United States of America. We are prepared to make profits from the industry and we will do all that is permitted by the law in the United States to achieve our business goals. Our business offerings are listed below;

- Private equity funds

- Hedge funds

- Closed-end funds

- Unit investment trusts

- Trade in financial products

- Related investment consulting and advisory services

4. Our Mission and Vision Statement

- Our vision is to build a private equity brand that will become one of the top choices for investors in the whole of Medford – Oregon. We want to be known for professionalism and outstanding results.

- Our mission is to position the business to become one of the leading brands in the Private Equity, Hedge Funds & Investment Vehicles industry in the whole of Medford, and also to be amongst the top 20 private equity firms in the United States of America within the first 10 years of operation.

Our Business Structure

The truth is that it won’t be out of place if we decide to settled for two or three staff members, but as part of our plan to build a standard private equity firm, we have perfected plans to get it right from the beginning which is why we are going to hire qualified, competent, honest and hardworking employees to occupy all the available positions in our firm.

The picture of the kind of the private equity firm we intend building and the business goals we want to achieve is what informed the amount we are ready to pay for the best hands in Oregon and environs as long as they are willing to work with us. Below is the business structure that we will build Thomas McKenzie® Private Equity Firm, Inc.;

- Chief Executive Officer

- Private Equity Consultants/Investor Specialists

Admin and HR Manager

Risk Manager

- Marketing and Sales Executive

- Chief Financial Officer (CFO)/Chief Accounting Officer (CAO).

- Customer Care Executive/Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Office:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Creates, communicates, and implementing the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Private Equity Consultants/Investor Specialist

- Provides market research and implementing new investment product and strategies

- Create research and review platforms for new, existing and potential investment products

- Exceed client expectations with returns on investments

- Works closely with analysts and traders to ensure trading strategy is carried out correctly

- Construct and review performance reports to show to investors

- Performs due diligence visits and assessing investment management firms and quantitatively analyzing investment pools

- Plans, designs and implements an overall risk management process for the organization

- Performs risk evaluation which involves comparing estimated risks with criteria established by the organization such as costs, legal requirements and environmental factors, and evaluating the organization’s previous handling of risks;

- Establishes and quantifies the organization’s ‘risk appetite’, i.e. the level of risk they are prepared to accept;

- Performs risks reporting in an appropriate way for different audiences, for example, to the board of directors so they understand the most significant risks

- Carries out processes such as purchasing insurance, implementing health and safety measures and making business continuity plans to limit risks and prepare for eventualities

- Conducts audits of policy and compliance to standards, including liaison with internal and external auditors;

- Provides support, education and training to staff to build risk awareness within the organization.

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Designs job descriptions with KPI to drive performance management for clients

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

Marketing/Investor Relations Officer

- Identifies prioritizes, and reaches out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts

- Responsible for handling business research, marker surveys and feasibility studies

- Documents all customer contact and information

- Represents the company in strategic meetings

- Help to increase growth for the company

Chief Financial Officer (CFO)/Chief Accounting Officer (CAO)

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Prepares the income statement and balance sheet using the trial balance and ledgers prepared by the bookkeeper.

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis

- Performs cash management, general ledger accounting, and financial reporting for one or more properties

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Client Service Executive/Front Desk Officer

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s services

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels/documents for the company

- Distribute mails in the organization

- Handles any other duties as assigned by the line manager

6. SWOT Analysis

Thomas McKenzie® Private Equity Firm, Inc. engaged the services of a professional in the area of business structuring to assist our organization in building a well – structured private equity firm that can favorably compete in the industry.

Part of what the business consultant did was to work with the management of our organization in conducting a SWOT analysis for Thomas McKenzie® Private Equity Firm, Inc. Here is a summary from the result of the SWOT analysis that was conducted on behalf of Thomas McKenzie® Private Equity Firm, Inc.;

Our core strength lies in the power of our team; our workforce. We have a team that can give our clients good returns on their investment; a team that are trained and equipped to pay attention to details and to deliver excellent jobs. We are well positioned and we know we will attract loads of clients from the first day we open our doors for business.

As a new private equity firm, it might take some time for our organization to break into the market and gain acceptance especially from corporate clients in the already saturated Private Equity, Hedge Funds & Investment Vehicles industry, that is perhaps our major weakness. So also we may not have the required cash to give our business the kind of publicity we would have loved to.

- Opportunities:

The opportunities in the Private Equity, Hedge Funds & Investment Vehicles industry is massive considering the number of investors and small businesses who would need investment support from private equity firms to grow their businesses and increase their profits. As a standard and accredited private equity firm, we are ready to take advantage of any opportunity that comes our way.

Private equity services involve a large amount of cash and it is known to be a very high risk venture, hence whoever chooses to manage it must not just have solid investment background, but must also know how to handle risks and discover potential thriving businesses and opportunities.

The truth is that if you are not grounded in risks management as a private equity, you may likely throw away peoples’ monies. Just as in any other business and investment vehicles, regulations, tax, economic downturn, unstable financial market and unfavorable government economic policies can hamper the growth and profitability of private equity firms.

7. MARKET ANALYSIS

- Market Trends

A close observation of happenings in the industry shows that in the dawn of recessionary declines, the industry is expected to continue on a path to growth, but not without a few ups and downs. As a result of this trend, Private Equity, Hedge Funds & Investment Vehicles industry revenue is expected to grow over the five-year period at an annualized rate of 7.3 percent.

The revenue growth for the industry was restrained in the early part of the period as the industry was reluctant to bounce back from the financial crisis and subsequent recession of the prior period that caused stock markets and business activity to dramatically contract in the United States.

The nature of private equity investment requires the services of core investment professionals. As a matter of fact, before any investor can commit their hard earned money under your care as a hedge fund manager, they usually would want to know your profile.

On the average, private equity firms employ strategies that can help them reduce market risk specifically by shorting equities or through the use of derivatives.

This is why many investment strategies, mostly arbitrage strategies, are limited as to how much capital they can successfully employ before returns starts diminishing. Little wonder most successful fund managers place limit on the amount of capital they will accept per time.

8. Our Target Market

Private equity is simply an investment medium that enables big time accredited investors pool cash or capital together to be able to invest in securities and any other form of investment opportunity that requires large initial capital to invest.

The fact that hedge funds requires large capital makes it easier for only the rich and accredited investors to cash in on it. Hedge funds are only open to limited partners with the required cash for investing in capital intensive business portfolios.

Our target market cuts across businesses and investors that are willing to invest. We are coming into the industry with a business concept that will enable us produce good returns on investment for our clients. Below is a list of the individuals and organizations that we have specifically designed our services for;

- Accredited Investors

- Wealthy People in the Society

- Investment Clubs

- Top corporate executives

- Corporate Organizations / Blue Chip Companies

- Small and medium scales businesses

Our competitive advantage

Despite the fact that private equity investment strategies give huge returns on investment, it is indeed risky venture. For you to survival as a private equity firm, you should be able to come up with workable investment strategies; strategies that will help you attract the required cash/capital and above all you should be a good risk manager and one that can spot a potential thriving business from afar.

We are quite aware that to be highly competitive in the industry means that we should be able to give good returns on investments to our clients, turn around the fortunes of a dying company for good , spot potential successful business ideas and invest in them, deliver consistent quality service, our clients should be satisfied with our investment strategies and we should be able to meet the expectations of our clients.

Thomas McKenzie® Private Equity Firm, Inc. might be a new entrant into the Private Equity, Hedge Funds & Investment Vehicles industry in the United States of America, but their management staff are highly qualified portfolio management experts in the United States. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry, meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

Sources of Income

Thomas McKenzie® Private Equity Firm, Inc. is established with the aim of maximizing profits in the Private Equity, Hedge Funds & Investment industry and we are going to ensure that we do all it takes to attract clients on a regular basis. Thomas McKenzie® Private Equity Firm, Inc. will generate income by offering the following investment related services;

10. Sales Forecast

One thing is certain, there would always be accredited investors, small and medium scale businesses and wealthy individuals who would need the services of tested and trusted private equity firms.

We are well positioned to take on the available market in Medford and other key cities in the United States of America and we are quite optimistic that we will meet our set target of generating enough profits from our first six months of operation and grow the business and our clientele base.

We have been able to examine the Private Equity, Hedge Funds & Investment industry, and we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. Below is the sales projection for Thomas McKenzie® Private Equity Firm, Inc., it is based on the location of our business and the wide range of investment management services that we will be offering;

- First Fiscal Year: $750,000

- Second Year: $ 1.5 Million

- Third Year: $3 Million

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor offering same services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

As a business that aims to stay at the top of our game and generate consistent income, our sales and marketing team will be recruited base on their vast experience in the industry and they will be trained on a regular basis so as to be equipped to meet the overall goal of the organization.