- Business Ideas

- Registered Agents

How to Start a Debt Counseling Business in 14 Steps (In-Depth Guide)

Updated: April 1, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

The debt counseling industry has grown rapidly in recent years as consumer debt levels continue to climb. The global debt counseling services market earned $311.95 million in 2022. It continues to grow with a projected compound annual growth rate (CAGR) of 5.12% from 2022 to 2028.

If you have experience in finance, a debt counseling service may be an ideal small business idea to pursue. Not only can you potentially tap into a multi-billion dollar industry, but you’ll also have the satisfaction of helping everyday Americans get out of debt.

This guide will walk you through how to start a debt counseling business. Topics include market research, registering an EIN, obtaining business insurance, sourcing equipment, organizing startup and ongoing costs, and more. Here’s everything to know about starting a certified credit counselors business.

1. Conduct Debt Counseling Market Research

To determine if a debt counseling business is viable, the first step is conducting thorough market research. This will shed light on industry trends, target demographics, competitive forces, startup costs, and revenue potential.

Some details you’ll learn through market research on your debt consolidation business include:

- Driving this growth is the alarming fact that U.S. consumer debt continues ballooning year after year.

- Since the Great Recession, Americans with credit card debt climbed back up to 176 million citizens carrying over $930 billion in revolving balances.

- Total household debt recently hit a record $16.15 trillion according to the New York Federal Reserve.

- With high debt burdens persisting nationwide, the target market for debt counseling is enormous.

- Over 100 million adults admit their debt load is unmanageable.

- 45% report their balances prevent them from saving money or investing for the future.

- When sizing up the competitive landscape, debt counselors face obstacles from debt settlement agencies, credit counseling non-profits, debt collection agencies , and debt consolidation lenders.

- There are still abundant prospects of not receiving adequate services from these options.

- As for startup costs, overhead expenses often range from $2,000-$5,000 when first launching.

- This covers items like certification/licensing fees, a reliable computer and software, website hosting, and office basics.

- Ongoing monthly expenses tally around $500 for website maintenance, advertising, insurance, etc.

- It’s also wise to keep at least 3 months of savings to cover personal living costs while establishing your clientele.

The next step after reviewing these metrics is drafting a formal business plan. Crunching the numbers will verify if a debt counseling venture aligns with your financial goals and risk tolerance. But the market opportunity and societal need make for a compelling case.

2. Analyze the Competition

Carefully scrutinizing your competition is imperative when launching a debt counseling venture. This gives insight into prevailing rates, services, marketing tactics, and unmet consumer needs.

For area brick-and-mortar practices, search online directories and drive around town to identify providers. Take notes on locations, office aesthetics, posted hours, and first impressions of websites if available. Also, document what counseling packages and payment options are advertised.

To gauge competitive rates, you can call and ask questions anonymously. Inquire about intro sessions, monthly retainers, additional fees, qualifications of counselors, and what outcomes they guarantee. Take detailed notes of all pricing plans and offerings.

Online competitors can be trickier to analyze. But focus first on other counselors’ marketing services in your state. Search engines, online ads, and social media are good places to uncover these businesses.

Vet each online competitor’s website and social media presence. Check for testimonials, company history, founder/staff bios, press features, community involvement, session formats, and contact options. Also, note their web traffic via SimilarWeb data or Alexa rankings.

For larger national chains, research their headquarters location, leadership team, number of centers, client results, and brand reputation. News articles can also provide insight into their financial backing, business model, past controversies, etc.

Regularly repeat this competitive analysis to see new entries in your area. And track whether existing providers adjust rates, offerings, or marketing messages over time. This helps you ensure your counseling business always stays ahead of consumer needs and local rivals.

3. Costs to Start a Debt Counseling Business

When embarking on a new debt counseling venture, prudent financial planning is a must. Carefully projecting both initial and recurring expenses ensures you budget adequately. This helps safeguard personal finances while allowing your practice to grow on firm fiscal ground.

Startup Costs

- Licensing or credentials required in your state. The National Foundation for Credit Counseling charges $695 for individual certification.

- A new computer/laptop, printer/scanner combo, accounting software, cybersecurity programs, and website hosting account generally tallies $2,500 – $3,000 upfront.

- Renting temporary hourly slots at a shared workspace at around $250/month or leasing a small private office for around $400-$800 monthly.

- On average, most new counselors need around $10,000-$15,000 in personal savings when starting.

Ongoing Costs

- Set aside $3,000-$5,000 for insurance, marketing, accounting services, legal retainers, office supplies, and software subscriptions.

- Budget around $1,000-$2,000 per month for a blend of digital promotions, local print ads, event sponsorships, direct mailers, etc.

- Plan for website hosting, content creation/SEO services, email/CRM platforms, and social media management to cost around $500 monthly.

- Payroll for any administrative assistants or counselors could tally another $2,500+ depending on staff size.

- Recurring costs of rent, utilities, insurance, accounting help, office supplies, software, etc. These generally add up to around $1,500 per month.

Keep close tabs on precise expenses and sales revenues with accounting software. This allows tweaking budgets as needed while scaling your profits month-to-month and year-over-year.

4. Form a Legal Business Entity

When establishing a debt counseling practice, properly structuring your legal business entity is critical. This impacts liability protection, taxes, operational processes, investor options, and more. Weighing the pros and cons of each framework steers most new counselors towards launching as a limited liability company (LLC).

Sole Proprietorship

Sole proprietorships offer simplicity but leave you personally responsible if sued. All company debts and legal judgments are attached to your assets. This is a good choice for a single owner, or a married couple owning a business together.

Partnership

Partnerships allow sharing operations and expenses with a co-owner but still lack liability safeguards. Incorporating brings limited protection, but mandates extensive record-keeping and double taxation.

Limited Liability Company (LLC)

LLCs provide the best of all worlds for fledgling debt counselors. You get the flexibility of a management structure akin to a partnership. Tax burdens and filings also mirror a sole proprietorship based on pass-through status. Most vitally, an LLC shields your assets if professional liabilities arise.

Corporation

A corporation also protects your assets. This business formation is the most complex and expensive. Most small businesses choose an LLC formation over a corporation, which is better suited to large enterprises.

5. Register Your Business For Taxes

Before accepting any payments from debt counseling clients, you must legally register your business for federal and state tax purposes. This requires applying for an employer identification number (EIN) and sales tax permits.

An EIN acts like a social security number for your business. It uniquely identifies your company and allows opening business bank accounts, paying employees, and filing tax returns. EINs are free and easy to obtain from the IRS in minutes.

Simply navigate to the EIN Assistant page on IRS and answer a few questions about your LLC’s structure and activities. On the final page, provide your personal information for verification. Instantly receive your EIN and a PDF of your confirmation notice.

Save this EIN confirmation document along with your LLC paperwork. Lenders often require both when financing office space, equipment purchases, business credit cards, and more.

You must also register with your state revenue department for sales tax collection. Most states charge no fee and the application takes under 15 minutes online. Submit basic data on your counseling business like name, address, EIN, and projected revenues.

In return, you get a state tax ID number or sales permit. Now you can legally charge sales tax on any services billed to local clients. You simply remit collected sales tax to the state each month or quarter when filing business tax returns. Most states also let you pay sales tax online for convenience.

6. Setup Your Accounting

Meticulous financial tracking is imperative when launching a debt counseling venture. This not only wards off IRS scrutiny but equips you with data to optimize profits over time. Investing in robust accounting infrastructure from day one establishes healthy fiscal practices as you scale.

Accounting Software

Begin by purchasing small business accounting software like QuickBooks . The basic QuickBooks package starts around $15/month and syncs directly with your business bank/credit card accounts. In seconds it imports all transactions so you have a centralized ledger.

Hire an Accountant

But for maximum accuracy, partner with an accountant specializing in counseling practices. Expect to invest around $200 per month for standard bookkeeping and reconciliation work. They’ll ensure 100% of credits/debits are properly coded. This gives you clean quarterly financials to analyze.

Open a Business Bank Account

A key pillar of solid accounting is separating business and personal finances. Never comingle funds by paying vendors from a personal account or covering household bills from business earnings. Open a dedicated business checking account using your EIN and LLC paperwork.

Apply for a Business Credit Card

Apply for a business credit card. Lenders determine limits based on your LLC’s projected revenues, not personal credit scores. A business card builds commercial credit history and keeps purchases easy to classify. Just link it to accounting software for seamless tracking.

7. Obtain Licenses and Permits

Before seeing your first debt counseling client, ensure your practice complies fully with all federal and state credentialing regulations. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

At the federal level, the FTC’s Telemarketing Sales Rule mandates that any firm charging advance fees for debt relief services must maintain minimum bonding requirements. While rules vary by state, most mandate bonds between $50,000 to $100,000.

Work with your insurance agent to secure an appropriate surety bond for your locale. Submit required paperwork to verify coverage including your EIN confirmation, business license, operating agreement, etc. Bonds generally cost 1%-3% of the total coverage amount as an annual premium.

Several states also enforce special licensing around debt adjusting and settlement advice. For example, New York requires a debt adjuster license from the Department of Financial Services involving an exam, training courses, and application fees totaling $1,200+.

Research if your state has similar red tape around debt counseling/modification services. If so, schedule test prep plus budget for license costs. Renewals with required continuing education also tally a few hundred dollars annually.

An additional permit relates to protecting client information. All practices must comply with Gramm–Leach–Bliley Act mandates around securing sensitive data. This means implementing cybersecurity software, encrypted storage/emails, confidentiality agreements with any staff or contractors, and transparent privacy policies.

Consult an attorney to ensure your cyber protection protocols and customer notifications meet state and federal regulations. Penalties for compromised client data start around $100 per violation.

8. Get Business Insurance

Though not legally mandated, securing adequate insurance defends your hard work as a debt counselor against financial threats. Policies shield your practice from heavy losses whether facing minor mishaps or major lawsuits.

Imagine slipping on a slick office floor and breaking your writing arm a week before tax deadlines. Without disability coverage, you cannot work or collect income for months. Or envision a creditor accusing you of mismanaging a past client’s repayment plan.

Other scenarios like fire damage destroying your office or computer files getting hacked have severe consequences without proper coverage. Just one disastrous event can permanently close unprotected practices.

Start by bundling general liability with professional liability, cyber insurance, and small business property coverage. Ballpark $150 monthly for robust protection including damages from mistakes, disasters, or lawsuits. Though costs vary based on business size, location, and policy limits.

An insurance agent guides securing the optimal bundle. Reach out to various brokers requesting quotes on debt counselor policies. Provide your business license, corporate documents, and forecasts. Brokers tailor coverage/premiums to your situation.

Carefully review all policy documents before signing to ensure adequate coverage levels and reasonable deductibles if claims arise. Also, confirm whether insurer payouts cover legal defense bills or just awards/settlements. Such fine print prevents nasty surprises during crises.

With bespoke insurance backing your practice, you safely advise clients through financial recoveries without jeopardizing your stability. This peace of mind fuels focusing completely on your counseling work rather than distracting liability woes.

9. Create an Office Space

A dedicated office space lends legitimacy when meeting sensitive clients seeking financial guidance. It also provides quiet, confidential environments facilitating open money conversations. Weigh options come down to budget, growth goals, and counseling session formats.

Home Office

Home offices offer autonomy and ultra-low overhead. Expect around $2,000 in upfront costs for a desk, chair, computer, secure locking cabinetry, and basic office supplies. Monthly bills tally under $200 for internet, software, phone service, etc. This frees capital for marketing efforts to drive client traffic.

Coworking Office

Coworking spaces like WeWork provide modern officing flexibility starting around $350 monthly. You only pay for the exact office hours needed rather than signing long leases. Coworking staff handle facility management, security, mail reception, and more so you focus on your practice.

Commercial Office

For the most professional experience, rent a private office in a commercial building. Expect all-in monthly rents of around $1,000 for a modest 150 sq ft office in most regions. Top amenities like custom branding displays, sound insulation, and client reception areas project success. You also control data and physical security protocols.

10. Source Your Equipment

Launching a debt counseling venture demands minimal supplies like office furniture, technology, branding elements, etc. Strategize the most affordable routes based on expected client volumes and revenue forecasts.

Buying brand-new equipment from retailers allows customizing configurations but carries higher upfront costs. Shop mainstays like Office Depot , Staples , Best Buy , and Amazon for the latest ergonomic chairs, standing desks, desktops/laptops, printers, office phones, etc. Expect roughly $3,000 altogether buying new.

Gently used and open box items found online slash initial investments substantially. Scan for liquidation listings on Facebook Marketplace , Craigslist , eBay , and OfferUp in your area. If willing to thoroughly clean and sanitize items, secondhand furniture and tech provide major savings. Budget $500-$1,500 buying used equipment.

Rent or Lease

Renting or leasing major assets adds flexibility as your business evolves. Copier/printer leases through vendors like Xerox run $30-$75 monthly including toner and maintenance. Finance essential tech like computers for 0% interest around $100 per month through Dell . This preserves capital for marketing and operations.

11. Establish Your Brand Assets

Crafting a distinctive brand identity fuels recognition, referrals, and retention as you start counseling debt-laden clients. Invest time upfront in branded touchpoints projecting expertise.

Get a Business Phone Number

Begin by acquiring a dedicated business phone line using a service like RingCentral . Toll-free numbers with custom greetings run just $30 monthly. This enhances professionalism when prospects call your practice.

Design a Logo

Create a sleek logo reflecting your debt expertise. Services like Looka offer unlimited DIY designs starting at $20 monthly. Upload Inspiration and Looka’s AI generate tailored logo options using elements like financial symbols and calming colors. This visual identity anchors all branding.

Print Business Cards

Print new letterhead, business cards, brochures, and office signage displaying the logo through convenient online print shops like Vistaprint . Share cards when meeting prospects to spur follow-ups. And post bold exterior signage so visitors can easily find your office.

Design a Website

Concurrently, establish an online presence and content hub with a dedicated website. User-friendly builders like Wix facilitate quick launch with 500+ template styles from $14 monthly. Or hire an affordable web developer on freelance sites like Fiverr starting at around $500 in total.

Buy a Domain Name

Anchor the site with a custom domain name purchased through registrars like Namecheap for around $20 annually. Choosing an exact match name like DebtHelpExperts improves SEO and memorability.

12. Join Associations and Groups

Joining local professional groups and associations jumpstarts networking among regional peers also navigating financial advisory ventures. This facilitates sharing best practices plus generating referral partnerships over time.

Local Associations

Search online directories for a national association or debt counselor alliance in your state, like the American Association of Debt Resolution . Annual dues (around $300) grant access to conferences, compliance insights, ethical standards, and insider connections.

Local Meetups

Local Meetup groups also abound for money-minded entrepreneurs like financial advisors, CPAs, bankers, and alternative lenders. Meetups organize informal peer meetups at local cafes plus annual trade shows. Join relevant groups and attend events to exchange business cards with compatible professionals.

Facebook Groups

Peer input gets candid within dedicated industry forums on Facebook. Groups like, Let’s Talk About Debt and Debt Help & Tips Group pose questions on regulations, techniques, marketing tactics, and workplace issues relevant to a new debt consolidation business.

13. How to Market a Debt Counseling Business

Implementing an omnichannel marketing strategy is vital for attracting new debt counseling clients while reinforcing trust with existing ones. Combine digital promotions, community networking, and client referrals to achieve rapid, profitable growth.

Personal Marketing

Tap your inner circle excited to support a new local business. Offer incentives like free consultations to colleagues, friends, and family seeking financial advice. Satisfied early customers organically spread your brand if pleased with transparency and results.

Digital Marketing

- Launch Google Ads campaigns to appear atop search results for related keywords like “debt counselor near me” or “credit card consolidation help”

- Run Facebook/Instagram ads targeted locally featuring client testimonial videos

- Start an educational YouTube channel answering common debt questions

- Host a financial advice blog with SEO-optimized articles bringing organic visitors

- Provide free downloadable debt calculator/workbook tools in exchange for emails

Traditional Marketing

- Print client testimonial rack cards for waiting areas of strategic partners like CPAs, banks, and realtors

- Sponsor community events and host debt-focused seminars at local libraries

- Advertise on public radio during drive-time shows aligned with fiscally-minded listeners

- Claim localization listings on directory sites like Yelp highlighting rave reviews

While digital channels enable scalable outreach, local partnerships, and promotions also steadily expand awareness. The hybrid approach nurtures a recognizing client base within surrounding neighborhoods over time.

14. Focus on the Customer

All debt consolidation businesses require customers to be successful. Your debt consolidation services should cater to your target audience, and every personal touch you add does just this. To draw in high-risk merchants looking for debt help, use your customer service talents.

Some ways to improve customer focus as you develop your financial counseling brand include:

- Follow-up phone calls: After working with a client, follow up to see how they’re doing and whether any further services are required of your debt consolidation company.

- Thank you cards: On top of follow-up calls or emails, a tangible thank you card goes a long way to make customers feel appreciated.

- Maintain consistency: Train any staff on your team with the same guidelines to maintain consistency among credit counselors on your team.

- Special offers: Provide exclusive offers to the local market to build loyalty and foster referrals.

- Partner: Network and partner with community organizations to extend your reach and show locals you care.

The debt reduction business has plenty of room for newcomers. Build your mark on the industry by living up to your mission statement. Show potential customers, and returning clients why you’re the best choice in the local area for debt counseling.

You Might Also Like

March 8, 2024

0 comments

How to Start a Budgeting Coach Business in 14 Steps (In-Depth Guide)

The personal finance coaching industry has exploded in recent years. Between the overall task ...

How to Start a Credit Score Counseling Business in 14 Steps (In-Depth Guide)

The credit score counseling industry has seen steady growth in recent years. According to ...

March 1, 2024

How to Start an Investment Advisory Business in 14 Steps (In-Depth Guide)

The investment advisory services industry is on the rise. It’s expected to grow at ...

How to Start a Bookkeeping Business in 14 Steps (In-Depth Guide)

The bookkeeping industry is booming, with an expected compound annual growth rate (CAGR) of ...

Check Out Our Latest Articles

How to start a dog clothing business in 14 steps (in-depth guide), how to start a vintage clothing business in 14 steps (in-depth guide), how to start a bamboo clothing business in 14 steps (in-depth guide), how to start a garage cleaning business in 14 steps (in-depth guide).

Counseling Private Practice Business Plan Template

Written by Dave Lavinsky

Counseling Private Practice Business Plan

You’ve come to the right place to create a comprehensive business plan for a private therapy practice.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their therapy practices.

Below is a template to help you create each section of your Counseling Private Practice business plan.

Sample Business Plan for a Mental Health Private Practice

Below is a business plan example to help you create each section of your therapy business plan.

Executive Summary

Business overview.

Peaceful Minds is a private counseling clinic that provides family and marriage counseling to residents living in or near Tigard, Oregon. The clinic primarily services couples and families with a variety of concerns, such as communication problems, mental illness, major life transitions, and affairs. The clinic employs highly-experienced counselors to assist clients with their mental health, help them navigate life challenges, and improve their quality of life. Counseling sessions can be conducted in-person or remotely, and an affordable sliding scale fee system is offered to families earning below the local median salary.

Peaceful Minds is led by Lydia White, who has been a marriage and family therapist for ten years. She has worked in other private practices around the community and has sustained a very positive reputation. Lydia is trained in Imago Relationship Therapy (IRT) and will use that as her primary means of helping clients. However, she will employ other therapists who provide other forms of relationship and family therapy.

Product Offering

Below is a list of the services that Peaceful Minds will offer to its clients:

- Marriage counseling: This service helps married clients to overcome challenges in their marriage/relationship. Marriage counselors can help married clients with communication problems, issues with intimacy, resolving major conflicts, and more.

- Family counseling: This service helps families work through their challenges and conflicts as a whole. Some example issues include integrating blended families, healing from divorce, and working through grief.

- Individual counseling: By request, clients who are part of family or couples sessions can have one-on-one sessions with the therapist to work further on their concerns. In these sessions, therapists help clients work through their emotions and thoughts concerning their marriage/family problems. Therapists can also help clients treat and cope with any mental health challenges they live with.

- Group therapy: Group therapy offers a supportive environment for clients to connect with others facing similar challenges. In group therapy, clients can share their experiences, receive support from peers, and learn new coping strategies.

Clients will also receive a complimentary initial intake to ensure they find a therapist that can help them with their goals. All sessions are offered in-person or remotely, depending on the client’s request.

Customer Focus

Peaceful Minds will primarily serve residents that live in Tigard, Oregon and the surrounding areas. Tigard is one of Oregon’s largest cities and has a large population of families, married couples, and divorced couples. The city also has a very high median salary, which means that many residents have the disposable income to invest in counseling. The demographics of Tigard show that there is an enormous target customer base that will benefit from our services.

Management Team

Peaceful Minds is led by Lydia White, who has been a marriage and family counselor for ten years. She primarily utilizes the Imago Relationship Therapy (IRT) technique to help her clients with their marriage or relationship concerns.

While Lydia has never run a private counseling practice herself, she has worked in private clinics for the duration of her career. She began her counseling career in 2013 shortly after completing her Master’s degree from Portland State University and obtaining her counseling license.

Success Factors

Peaceful Minds will be able to achieve success by offering the following competitive advantages:

- Affordable sliding scale fee: Counseling is an expensive investment for many clients. That’s why Peaceful Minds offers an affordable sliding scale fee structure to families who make less than the local median income.

- Remote or in-person sessions: Some people are eager to meet their counselors in person again, while others feel more comfortable connecting remotely. We allow clients to determine what form they want their sessions to take. We will only override this policy if another pandemic or public health concern occurs.

- Specialization in marriage and family matters: Very few clinics in town specialize in marriage and family counseling. Peaceful Minds will focus primarily on these matters, attracting this clientele from our competitors.

Financial Highlights

Peaceful Minds is currently seeking $300,000 to launch. The funding will be dedicated towards securing the office space and purchasing equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs. Specifically, these funds will be used as follows:

- Clinic interior build out and design: $50,000

- Office equipment, supplies, and materials: $20,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $30,000

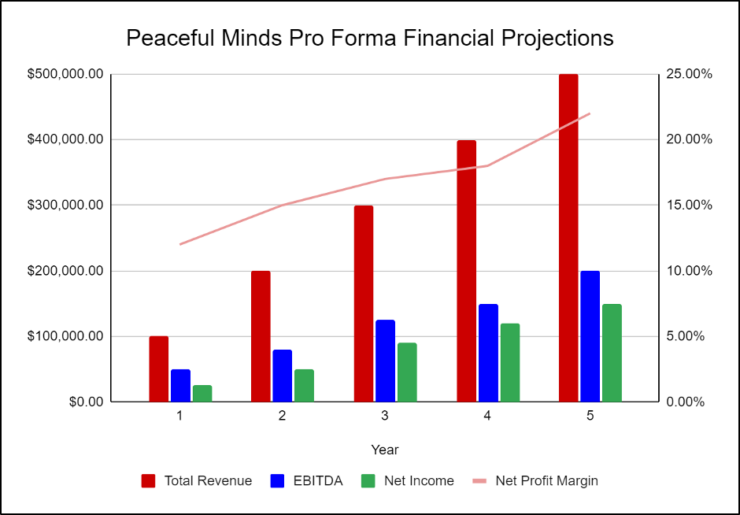

The following graph below outlines the pro forma financial projections for Peaceful Minds.

Company Overview

Who is peaceful minds, peaceful minds history.

After surveying the local client base and finding a potential clinic location, Lydia White incorporated Peaceful Minds as an S-Corporation on February 1st, 2023.

Currently, the business is being run remotely out of Lydia’s home office, but once a lease on the office location is finalized, all operations will run from there.

Since incorporation, Peaceful Minds has achieved the following milestones:

- Found a potential commercial space and signed a Letter of Intent to lease it

- Developed the clinic’s name, logo, social media accounts, and website

- Determined space design and required equipment

- Hired a virtual assistant to help with bookings and schedules

Peaceful Minds Services

Industry analysis.

The past few years have seen a revolution in the counseling industry. The importance of mental health and the benefits of talking with a counselor to cope with life’s challenges is on the rise. More than ever before, people are eager to work with a therapist as they navigate their challenges and improve their quality of life. This is creating a greater demand for therapists and counselors all around the nation.

There have also been some major shifts in marriage and divorce rates over the past few years. Divorces escalated during the pandemic, and marriages have been in decline for decades. We have also seen the rise of diverse families, such as families with same-sex parents and blended families. All of these changes create family, relationship, and marriage challenges that are far more diverse than decades past. Luckily, the stigma around therapy is dissolving, so more people than ever before are looking to counseling for help with their relationship or family matters.

Another recent change in the industry is the transition to remote services. Many people get their counseling sessions online through phone or video chat therapy, and this trend is expected to continue. However, now that the pandemic is over, more people want to go back to in-person sessions. Clinics that provide both options will have more resilience in the future.

A significant challenge that private practices face is major online therapeutic services. These services connect clients with therapists online from anywhere in the world. These essentially are “gig” opportunities for therapists and have gained popularity for several years for their affordable cost and convenience.

However, there has been significant pushback against these services due to the lack of quality counseling received and shady payment practices. As a result, many clients are returning to private practices to find therapists they can develop a true relationship with.

Customer Analysis

Demographic profile of target market.

Peaceful Minds will serve the residents of Tigard, Oregon and its surrounding area. Peaceful Minds will primarily target clients who are married and have families. The community of Tigard has a large population of married couples, so there are many clients that could utilize our services. The community also has a significant proportion of affluent and middle-class residents that will be willing to pay for quality services.

The demographics for Tigard, Oregon are as follows:

Customer Segmentation

Peaceful Minds will primarily target the following customer profiles:

- Married couples

- Millennials

Competitive Analysis

Direct and indirect competitors.

Peaceful Minds will face competition from other companies with similar business profiles. A description of each competitor company is below.

Riverside Therapy Center

Riverside Therapy Center has been a popular therapeutic clinic in town since 1988. It is a larger clinic, employing dozens of therapists, all with different backgrounds and areas of expertise. They offer counseling for individuals, couples, and families and have psychiatrists who can help with medication management. Clients who go to Riverside can get help coping with a diagnosis, navigating a major life transition, or working through conflict with their partners or family.

Tigard Mental Health And Wellness

Tigard Mental Health And Wellness was established in 2002 to address the mental health concerns of the community. Like Riverside, it is a larger clinic with many therapists to choose from. These therapists come from many backgrounds and offer a variety of treatments and counseling for many disorders and situations.

Portland State University Counseling Services

Portland State University offers affordable therapy offered by Portland State University. It is run by students who are training to become licensed therapists but do not have a license yet. They are supervised by their professors, who are trained, experienced, and licensed therapists. Because licensed professionals do not conduct the services, they are offered at an affordable rate and only to clients who are in the lowest economic brackets of the community.

Competitive Advantage

Peaceful Minds will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Peaceful Minds will offer the unique value proposition to its clientele:

- Convenient location

- Qualified and highly trained team of counselors and therapists

- Diversity of counselor team and clientele

- Comfortable, relaxing atmosphere

- Sliding scale for low-income families

- Option for remote or in-person sessions

Promotions Strategy

The promotions strategy for Peaceful Minds is as follows:

Website/SEO : Peaceful Minds will develop a professional website that showcases pictures of the clinic and the services we provide. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Social Media : Lydia White will create the company’s social media accounts and invest in ads on all social media platforms. The company will use targeted marketing to appeal to our target demographics.

Doctor’s Offices : Lydia will visit multiple doctors and primary care offices to ask them to refer our clinic to any patients looking for services. We will ask them to keep a handful of our brochures on hand and hand them out to whoever requests a counseling clinic or is in need of one.

Ongoing Customer Communications : Peaceful Minds will maintain a website and publish a monthly email newsletter to provide tips on common marriage and family challenges.

Peaceful Minds’ pricing will be moderate so clients feel they receive great value when utilizing our services. We will bill our clients’ insurance companies first and then charge our clients directly for whatever their plans don’t cover.

Operations Plan

The following will be the operations plan for Peaceful Minds.

Operation Functions:

- Lydia White will be the Owner of Peaceful Minds and oversee the general operations of the company. She will also provide therapy services to her initial client base.

- Lydia recently hired a virtual assistant named Sanuye Grant. She will help with scheduling appointments, basic marketing tasks, and other general administrative duties.

- As the company’s client base increases, Lydia will hire several other counselors with diverse counseling techniques and backgrounds to meet her clients’ needs.

Milestones:

Peaceful Minds will have the following milestones completed in the next six months.

- 07/202X Finalize lease agreement

- 08/202X Design and build out Peaceful Minds

- 09/202X Hire and train initial staff

- 10/202X Kickoff of promotional campaign

- 11/202X Launch Peaceful Minds

- 12/202X Reach break-even

Financial Plan

Key revenue & costs.

Peaceful Minds’ revenues will come primarily from therapy services. The company will bill the patient’s insurance for services provided, and the remainder will be billed to the patient. In cases where insurance is not accepted, the entire service will be billed to the patient.

The major cost drivers for the company’s operation will consist of salaries, supplies, equipment, the lease, taxes, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Year 4: 100

- Year 5: 150

- Annual rent: $100,000

- Average counseling session cost: $150

Financial Projections

Income statement, balance sheet, cash flow statement, private practice business plan faqs, what is a private practice business plan.

A business plan is a plan to start and/or grow your therapy practice. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Counseling Private Practice business plan using our Counseling Private Practice Business Plan Template here .

What are the Steps To Start a Private Practice?

Starting a private practice can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your business goals and get started faster.

1. Develop a Solid Business Plan – The first step in starting a business is to create a detailed therapy business plan that outlines all aspects of the venture. A solid private practice business plan should include market research on the counseling industry, potential market size and target customers, your mission statement, information about the services or products you will offer, marketing strategies and a detailed financial forecast.

2. Choose Your Legal Structure – It’s important to select an appropriate legal entity for your counseling private practice. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your counseling private practice is in compliance with local laws and other legal obligations.

3. Register Your Private Practice – Once you have chosen a legal structure, the next step is to register your practice with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options – It’s likely that you’ll need some capital to start your private practice, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location – Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees – There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Equipment & Supplies – In order to start your practice, you’ll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business – Once you have all the necessary pieces in place, it’s time to start promoting and marketing your counseling private practice. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to open a successful private practice:

How to Open a Counseling Private Practice Business

IMAGES

VIDEO

COMMENTS

A business plan will help you: • Analyse the environment in which your practice is going to be established. • Identify which areas in counselling are in high demand. • Establish what services you would be offering. • Differentiate you from competing private counsellors. • Set up your financial goals.

This guide will walk you through how to start a debt counseling business. Topics include market research, registering an EIN, obtaining business insurance, sourcing equipment, organizing startup and ongoing costs, and more. Here’s everything to know about starting a certified credit counselors business. 1.

Learning how to start a debt counseling business starts with the National Financial Educators Council – here are the top tips for this 6-step process.

What procedures? Financial Management and Growth Professional Growth. Personal Growth & Burnout Avoidance. References and Resources.

Online Counseling, often referred to as “Tele-Therapy”, is an up and coming way to deliver psychotherapy services. With this type of service you simply meet with clients online by video conferences. There are therapists that have built whole practices around providing this type of

A solid private practice business plan should include market research on the counseling industry, potential market size and target customers, your mission statement, information about the services or products you will offer, marketing strategies and a detailed financial forecast.