About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

- Faculty Recruiting

- See All Jobs

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Subscribe to Corporate Governance Emails

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

Xiaomi’s Globalization Strategy and Challenges

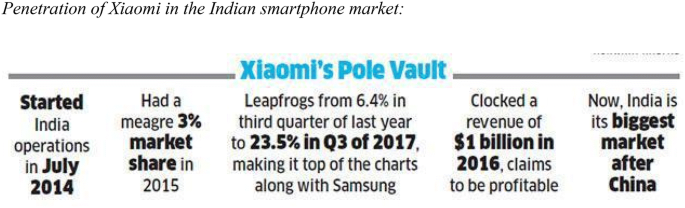

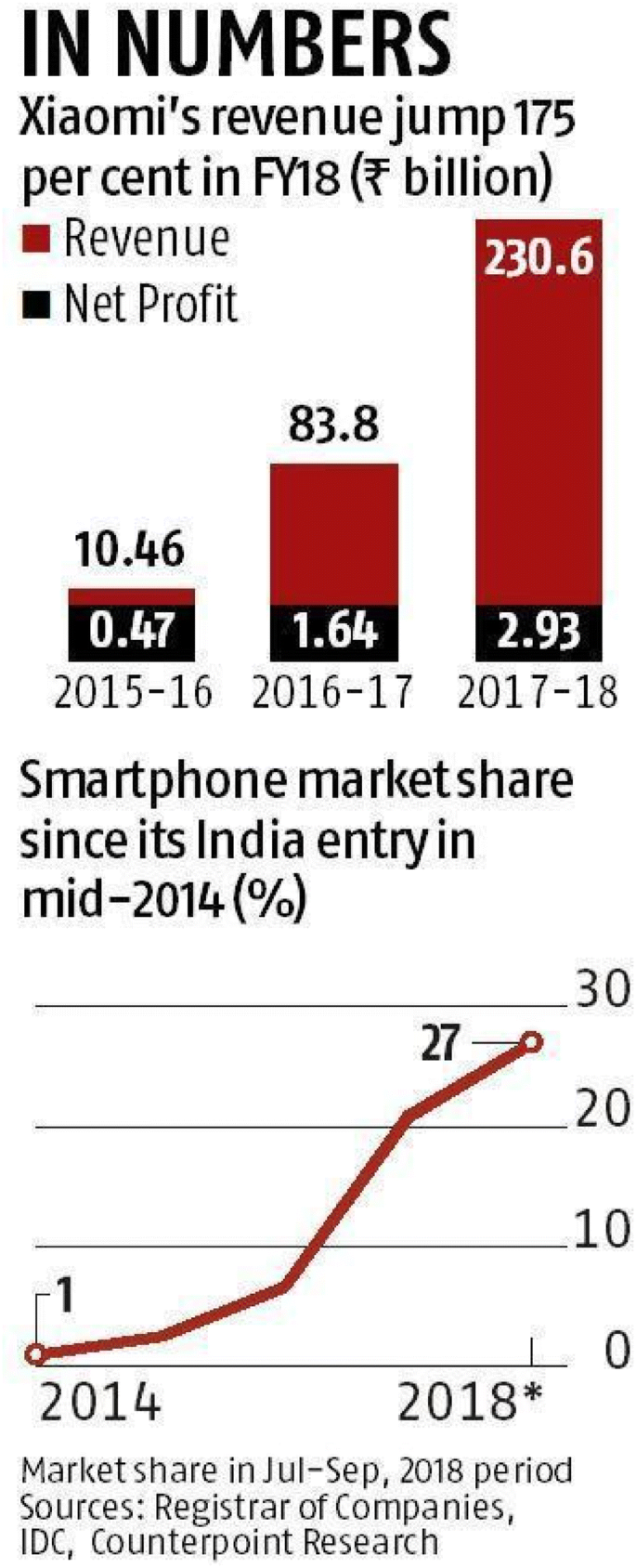

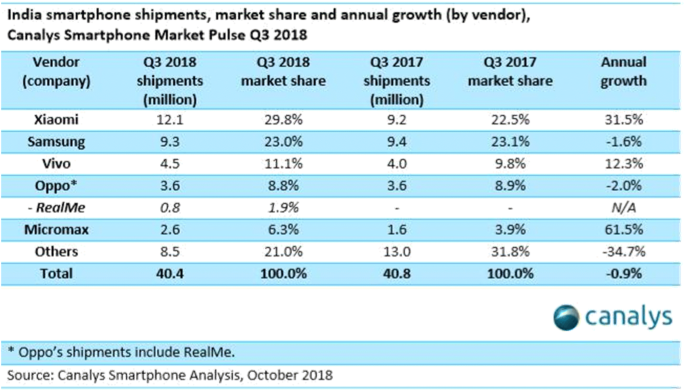

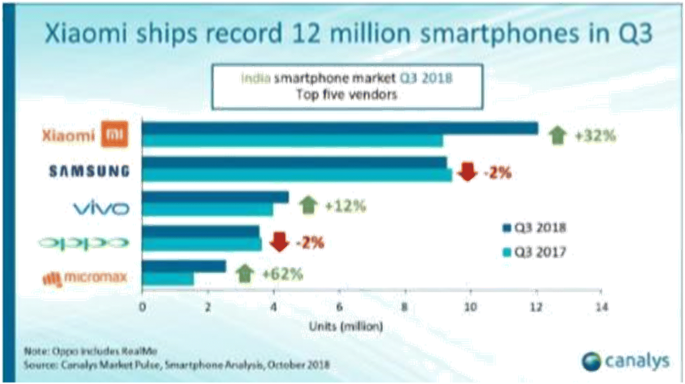

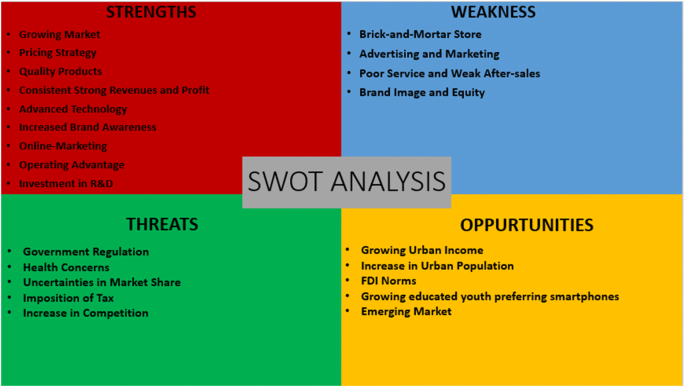

Xiaomi, the Chinese smartphone company founded in 2010, had quickly become an industry leader in the Chinese market. By 2016 it had started to expand internationally, and this case lays out the company’s globalization strategies and challenges moving forward. Hugo Barra, a top Android executive, had left Google a few years earlier to lead Xiaomi’s international growth. Xiaomi’s founder and CEO, Lei Jun, said the company’s ultimate goal was “making good but cheap things,” a low pricing strategy that had succeeded in China. The company sold over 70 million mobile phones in 2015—while aggressively building out a robust ecosystem. However, Xiaomi had expected to sell 80 to 100 million units that year; it was facing a declining domestic market and increased competition. Therefore, international expansion had become an important part of the company’s overall strategy.

But expanding to other countries would be a challenging road. For one, it would take considerable time and effort to tailor the company’s Android-based MIUI operating system for diversified markets—and obtain market-access qualifications. Xiaomi’s patent portfolio was thin compared to those of large competitors, and it ran the risk of lawsuits from companies that held patent rights in the countries it wanted to enter. Other challenges included building out sales channels, output capacity, and cross-culture management development. Xiaomi’s international plan included ten countries in Asia, Europe, and Latin America. The next year or two would be critical for Xiaomi—and it needed to make the right strategic decisions to succeed in its globalization efforts.

Learning Objective

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Annual Alumni Dinner

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Career Support and Resources

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Program Contacts

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- International Marketing

Xiaomi’s Global Strategy: From Local Hero to International Giant

- April 22, 2024

Table of contents

Xiaomi’s global strategy on the rise, xiaomi’s global rise: a recipe for success, a. product strategy: innovation meets affordability, b. building a strong brand: online and offline, c. distribution channels: a global network, d. localization: understanding the nuances of global markets, the role of translation services in xiaomi’s global success, challenges on the horizon, charting a course for continued growth, key learnings from xiaomi’s global strategy, actionable insights: lessons learned from xiaomi’s global success, faqs: xiaomi’s global strategy and localization.

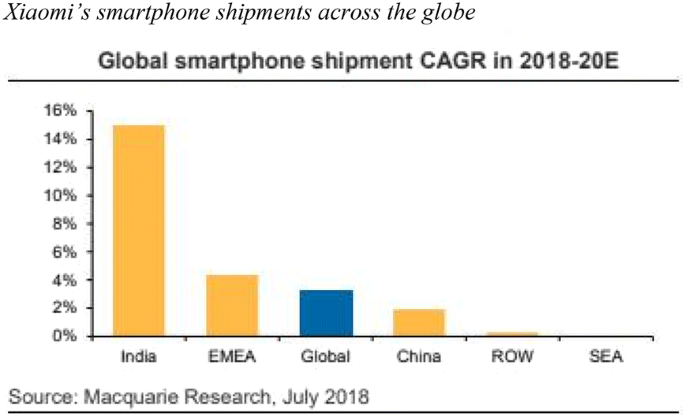

Xiaomi, a prominent Chinese tech company, has become a major force in the global smartphone market in a remarkably short timeframe. Founded in 2010, Xiaomi has captured the attention of consumers worldwide with its innovative products and competitive pricing strategy. In 2022, nearly half (49.2%) of the company’s revenue came from international markets , highlighting the success of Xiaomi’s global strategy ( Xiaomi , 2023). This article delves into the key elements of this strategy, exploring how Xiaomi has achieved international recognition and continues to expand its reach.

We will analyze Xiaomi’s rise to prominence, examining the factors that have propelled the company forward. We will then dissect Xiaomi’s global strategy, exploring its product development, marketing tactics, distribution channels, and approach to localization. Furthermore, we will investigate the potential challenges Xiaomi might face in the future and explore possible directions for its continued growth. By understanding Xiaomi’s global strategy, we can gain valuable insights into the ever-changing landscape of the technology industry .

Xiaomi’s meteoric rise to the top of the smartphone market can be attributed to several key factors that align perfectly with its global strategy. First and foremost, the company has prioritized offering consumers high-quality products at competitive prices . This value proposition has resonated strongly, particularly in emerging markets where price sensitivity is high. Xiaomi’s smartphones boast impressive features and specifications, often rivaling those of more expensive brands.

Secondly, Xiaomi has capitalized on the power of the internet by establishing a robust online sales strategy . This approach has allowed them to bypass traditional retail markups, further reducing costs for consumers. Additionally, Xiaomi has fostered a strong online community, fostering brand loyalty and engagement.

Beyond price and online savvy, Xiaomi has invested heavily in building a powerful brand image . Effective marketing campaigns have helped Xiaomi establish itself as a company that understands the needs of its customers and delivers innovative products.

Finally, Xiaomi’s vision extends beyond smartphones. The company has embarked on an ambitious strategy to create an ecosystem of interconnected devices , similar to Apple’s successful model. This includes smart home appliances, wearables, and other consumer electronics. This diversification allows Xiaomi to tap into new markets and provide a more comprehensive user experience.

By combining these elements, Xiaomi has carved a unique niche in the global technology landscape . Its focus on affordability, online presence, strong branding, and ecosystem development has fueled its impressive growth and positioned it as a major player in the global smartphone market.

Deconstructing Xiaomi’s Global Strategy: A Winning Formula

Xiaomi’s global strategy is a carefully crafted blueprint for success, built upon several key pillars. Let’s delve deeper into these elements to understand how Xiaomi has achieved such a strong international presence .

At the heart of Xiaomi’s global strategy lies a product strategy focused on innovation and user experience, delivered at competitive prices . The company prioritizes offering feature-rich smartphones that rival high-end models, all without breaking the bank. This approach has been particularly effective in emerging markets where price is a major consideration for consumers.

Furthermore, Xiaomi doesn’t limit itself to just smartphones. Their product portfolio is expanding to encompass a wider range of consumer electronics, creating an interconnected ecosystem similar to Apple’s. This includes smart home appliances, wearables, and other devices. By offering a comprehensive suite of products that work seamlessly together, Xiaomi caters to a wider audience and strengthens its brand loyalty .

A cornerstone of Xiaomi’s global strategy is its commitment to building a powerful brand image. The company leverages both online and offline marketing channels to reach consumers effectively. They have invested heavily in creating a strong online presence, fostering a vibrant online community that fosters brand loyalty and engagement. Social media plays a crucial role in their marketing strategy, allowing Xiaomi to connect with customers in target markets and understand their specific needs.

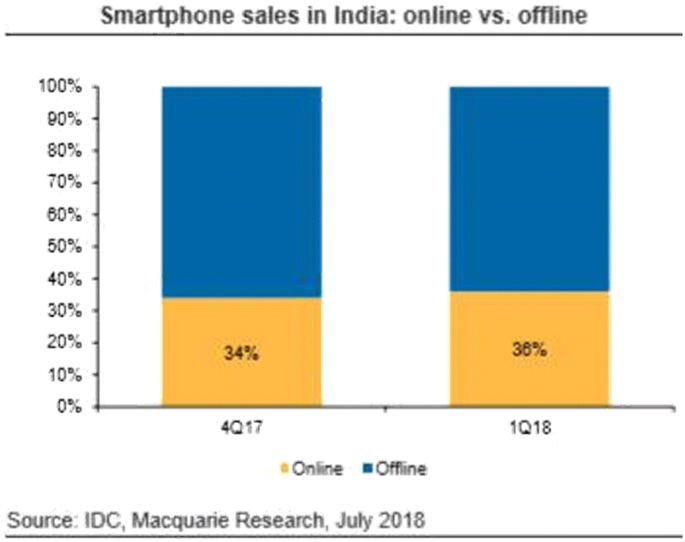

However, Xiaomi doesn’t neglect traditional marketing channels. They have expanded their presence in physical retail stores , making their products more accessible to a wider range of consumers. This blended approach ensures maximum reach and brand recognition across different demographics.

Xiaomi’s global strategy prioritizes establishing a robust distribution network to reach customers worldwide. They have established a dominant online sales presence, allowing them to bypass traditional retail markups and offer competitive pricing to consumers . However, Xiaomi recognizes the importance of physical retail stores as well. They have been actively expanding their presence in brick-and-mortar stores , offering customers a chance to interact with their products firsthand.

Building strong partnerships with local distributors is another key aspect of Xiaomi’s distribution strategy. By partnering with companies familiar with the local market landscape, Xiaomi can ensure efficient product delivery and provide excellent customer service in each region they operate in .

A crucial element of Xiaomi’s global strategy is its focus on localization . The company understands that a one-size-fits-all approach won’t work in a global marketplace. They take the time to adapt their products and marketing messages to suit the preferences and cultural nuances of each target market. This might involve modifying product features, offering localized language support, and tailoring marketing campaigns to resonate with local audiences. By demonstrating a commitment to understanding regional differences, Xiaomi builds trust and strengthens its brand image on a global scale.

Taking a closer look at these key ingredients of Xiaomi’s global strategy, we can unlock the secrets behind their remarkable success. Their commitment to innovation, affordability, building a strong brand, utilizing diverse distribution channels, and adapting to different markets has rocketed them to the top of the global tech world.

While Xiaomi’s global strategy excels in product development, marketing, and distribution, a key ingredient often goes unnoticed: translation services . For a company aiming to dominate international markets, clear and culturally-sensitive communication is paramount. Partnering with a professional translation agency plays a crucial role in Xiaomi’s success on a global scale.

Here’s how translation services contribute to the effectiveness of Xiaomi’s global strategy :

- Accurate and Culturally-Sensitive Marketing Materials: Reaching a global audience requires messaging that resonates with local cultures. A professional translation company can ensure Xiaomi’s marketing materials, from website content to social media posts, are accurately translated and adapted to the specific cultural context of each target market. This includes translating humor appropriately, avoiding offensive language, and using culturally relevant imagery. By ensuring clear and culturally-sensitive communication, Xiaomi avoids misunderstandings and builds trust with potential customers.

- Reaching a Wider Global Audience with Localized Messaging: Language barriers can be a significant hurdle in reaching new customers. Professional translation services allow Xiaomi to overcome this obstacle. By translating marketing materials and product information into the local languages of their target markets, Xiaomi significantly expands its reach. This allows them to connect with a wider audience and generate interest in their products across the globe.

- Building Trust and Brand Reputation in New Markets: Effective communication is essential for building trust with consumers. When Xiaomi presents itself in a language and cultural context that resonates with local audiences, it demonstrates a genuine understanding of their needs and preferences. This, in turn, fosters brand loyalty and a positive reputation in new markets. Professional translation services ensure Xiaomi’s brand message is conveyed accurately and respectfully, laying the foundation for long-term success in each region they operate in.

We often hear about Xiaomi’s impressive phones and aggressive pricing, but there’s another key player in their global success story: translation services. Accurate translations that are clear and sensitive to different cultures are crucial for reaching new audiences. By making sure their message resonates in each market, translation services empower Xiaomi to build trust, expand their reach, and solidify their position as a tech giant on the world stage .

Future of Xiaomi’s Global Strategy

As Xiaomi continues its global expansion, its global strategy must adapt to new challenges and capitalize on emerging opportunities. While Xiaomi has achieved remarkable success, there are potential roadblocks to consider .

- Increased Competition: The smartphone market is fiercely competitive, with established brands like Apple and Samsung constantly innovating. Xiaomi will need to maintain its focus on delivering high-quality products at competitive prices while also investing in cutting-edge features to differentiate itself from the competition.

- Geopolitical Tensions: Geopolitical tensions, such as the US-China trade war , can disrupt supply chains and impact market access. Xiaomi will need to develop strategies to mitigate these risks and ensure smooth operations across different regions.

- Maintaining Brand Reputation and Quality Control: As Xiaomi expands its product portfolio beyond smartphones, maintaining a consistent brand image and ensuring quality control across a wider range of devices will be crucial. This requires a robust quality control system and clear communication to customers about product features and specifications.

Despite these challenges, Xiaomi’s global strategy presents exciting possibilities for future growth . Here are some potential directions Xiaomi might explore:

- Continued Innovation Across Product Categories: Xiaomi’s commitment to innovation has been a key driver of its success. The company is well-positioned to continue pushing the boundaries in areas like artificial intelligence , internet of things (IoT) technology, and 5G connectivity . This will allow them to cater to evolving consumer needs and stay ahead of the curve.

- Expansion into New Markets and Demographics: Xiaomi has a strong presence in emerging markets but can further expand its reach by targeting new demographics and regions. This might involve tailoring products and marketing strategies to appeal to specific customer segments, such as budget-conscious consumers in developed markets or young adults in new geographic regions.

- Increased Investment in Research and Development: To maintain its competitive edge, Xiaomi will likely increase investment in research and development (R&D). This will allow them to develop next-generation technologies and ensure a steady stream of innovative products that meet the demands of a global audience.

If Xiaomi can stay ahead of the curve by addressing potential roadblocks and embracing these exciting new directions , their global strategy can take them even further. Their talent for adapting, constantly innovating, and meeting the needs of all kinds of customers will be crucial for their continued success in the ever-changing world of technology.

Xiaomi’s global strategy offers valuable insights for anyone interested in the dynamics of the technology industry and the challenges and opportunities of international expansion. Here are the key takeaways from our analysis :

- A Winning Formula: Xiaomi’s success hinges on a carefully crafted global strategy that prioritizes affordability, innovation, and a strong brand image. Their focus on delivering high-quality products at competitive prices, particularly in emerging markets, has resonated with consumers worldwide.

- Beyond Smartphones: Xiaomi’s vision extends beyond just smartphones. The company’s strategy of building an ecosystem of interconnected devices similar to Apple’s model positions them for future growth and caters to a wider range of customer needs.

- The Power of Localization: Understanding and catering to local preferences is crucial for success in a global marketplace. Xiaomi’s global strategy emphasizes localization, ensuring their products and marketing messages resonate with diverse cultural contexts.

- The Importance of Translation Services: Language translation services are an often-overlooked yet vital component of Xiaomi’s global strategy. By ensuring clear and culturally-sensitive communication across international markets, translation services empower Xiaomi to build trust and expand their reach.

The significance of Xiaomi’s global strategy transcends the smartphone market. It serves as a case study for companies aiming to achieve international success . Xiaomi’s ability to adapt, innovate, and cater to diverse customer needs on a global scale offers valuable lessons for businesses of all sizes looking to expand their reach beyond their home markets.

Cracking the code of Xiaomi’s global strategy isn’t just about understanding what they do well. It’s also about seeing the roadblocks and opportunities they face. With this knowledge in hand, businesses can craft their own winning formulas to navigate the ever-changing global market .

Xiaomi’s global strategy offers a wealth of practical guidance for businesses aiming to replicate its success in the international marketplace. Here, we explore actionable insights that go beyond the core elements already discussed :

Localization goes beyond just words. Xiaomi adapts product features, user manuals, packaging, and even website layouts to suit different regions. For instance, they might modify measurement units, adapt to local payment methods, and include warranty information in the local language.

Not necessarily. While Xiaomi might have a preferred partner for core projects, they may collaborate with various translation companies with expertise in specific regions or languages. This ensures a nuanced understanding of local dialects and cultural contexts.

Reputable translation agencies use a multi-step process to guarantee quality. This typically involves professional translators , editors familiar with the target market, and potentially even native speakers who review the final product for accuracy and cultural appropriateness.

Translation timelines can vary depending on the volume of content and the target languages. However, experienced language services providers have efficient workflows to ensure timely delivery. Xiaomi likely factors localization into their product development cycle to avoid delays.

Market research plays a crucial role. Xiaomi prioritizes languages spoken in regions with a high potential customer base or significant market growth. Additionally, factors like cultural similarities between regions might influence their translation choices.

Xiaomi’s global strategy emphasizes innovation, affordability, strong branding, and localization. They focus on high-quality products at competitive prices, particularly in emerging markets. Their distribution network combines online and offline channels, supported by strong partnerships. Localization, including culturally sensitive translations, is key to their success. Future challenges include increased competition and geopolitical tensions, but Xiaomi aims to maintain growth through continued innovation and expansion into new markets. 🌍📱

Thank you for your insights, Tanisha! Much appreciated! You’ve highlighted several key aspects of Xiaomi’s strategy, especially their commitment to affordability and innovation, which have indeed been instrumental in their rapid global expansion. I agree that their focus on localization and culturally sensitive translations has helped them resonate with diverse audiences, particularly in emerging markets.

It will be interesting to see how Xiaomi navigates the growing competition and geopolitical challenges in the coming years. Their ability to innovate while adapting to local market needs will be critical. I’m curious to hear your thoughts on how they might handle these challenges, especially as they expand into newer markets.

Thanks again for sharing your perspective!

Privacy Preferences

When you visit our website, it may store information through your browser from specific services, usually in the form of cookies. Here you can change your Privacy preferences. It is worth noting that blocking some types of cookies may impact your experience on our website and the services we are able to offer.

All You Need to Know about Xiaomi - The Popular Chinese Electronics Company

Himaya Presthitha , Chayanika Goswami

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations. The content in this post has been approved by Xiaomi.

‘Quality products at honest pricing’ is almost everyone’s need. Xiaomi has a separate fan base for its high-grade products built with cutting-edge technology at reasonable prices. Xiaomi is a Chinese company that has its major ground in electronics. The company has its presence in over 100 countries and regions and has been hailed as the world's most valued tech startup already in 2014. Xiaomi currently ranks in the 70th position on the Top 100 Most Valuable Global Brands in 2021 by Kantar BrandZ.

Xiaomi Mobiles have also gained much popularity in India, which has only seen growth year on year. The company tops the list of the best-selling phones in India. Xiaomi India even made it to the ‘GUINNESS WORLD RECORDS’ by building the largest light mosaic (logo) in the world. It was set by placing 9,690 bulbs and this momentous work is found on the terrace of Xiaomi’s head office in Bengaluru. Here are some more interesting facts and figures about Xiaomi.

Xiaomi – Company Highlights

About Xiaomi Xiaomi - Founders/Owners Xiaomi - History Xiaomi - Name, Tagline & Logo Xiaomi - Funding & Investors Xiaomi - Competitors Xiaomi - Revenue Model Xiaomi - Growth & Revenue Xiaomi - Future Plans

About Xiaomi

Xiaomi is an electronics company based in Beijing, China. It was founded by Lei Jun in April 2010, and in 2014, Xiaomi was the largest smartphone company in China. Today, Xiaomi is one of the top five smartphone vendors in the world. The smartphone commodities of Xiaomi include different series such as Mi Series, Mi Note Series, Mi Max Series, Mi Mix Series, Mi NoteBook Series, Redmi Series, Blackshark, and Pocophone. Xiaomi has around 291.6 million active users for its MIUI updates. Besides, the company also offers laptops, mobile apps, mobile accessories, wearables, home appliances, and smart-home devices.

From 2019, Xiaomi even started selling accessories such as caps, bags, glasses, backpacks, and also lunchboxes, pillows, cups, filters, umbrellas, and screwdrivers.

In 2018, Xiaomi launched Mi Credit in India for easy accessibility of personal loans. The company also offers various value-added-internet services like 'Mi Music', 'Mi Video' and 'Mi Game'.

Xiaomi - Founders/Owners

Lei Jun is the founder, CEO, and President of Xiaomi. The other co-founders are, Lin Bin, Dr. Zhou Guangping, Liu De, Li Wanqiang, Wong Kong-Kat, Hong Feng and Chuan Wang.

Lei Jun is a graduate in computer science from Wuhan University. In 1992, Lei Jun joined Kingsoft, a Chinese software company as an engineer. In 1998, Lei Jun became the CEO of Kingsoft. In December 2007, he resigned from Kingsoft for health-related issues. While he was still working with Kingsoft, Lei Jun founded an online bookstore named Joyo.com. Joyo.com was acquired by Amazon.com in 2004.

After resigning from Kingsoft, Lei Jun became an angel investor and invested in over 20 companies. He still invests in various companies through Shunwei Capital. In 2008, he joined UC Web as Chairman, and in 2010 Lei Jun founded Xiaomi.

Xiaomi co-founder & President Lin Bin is a graduate in radio electronics and holds a rich experience of working with companies like ADP, Microsoft, and Google. Lin Bin is also a member of the board of advisors of Tufts University School of Engineering located in Boston (USA).

Dr. Zhou Guangping , who is a Ph.D. in Electrical Engineering, worked with Motorola and held various pivotal positions in the company before joining Xiaomi. Currently, Dr. Zhou leads the hardware and BSP teams at Xiaomi.

Liu De is an M.S. and an expert in Industrial design. He established the Industrial Design Department at the University of Science and Technology Beijing. In 2003, Liu De founded 'New Edge', an Industrial Design Company. Mr. Liu currently looks after the industrial design and Ecosystem Development teams at Xiaomi.

Li Wanqiang is known as one of the earliest UI and HCI experts in China. After completing his graduation in Industrial Engineering in 2000, Mr. Wanqiang joined Kingsoft, where he was leading many important and well-known software projects. In 2010 Wanqiang joined Xiaomi as a co-founder.

Wong Kong-Kat graduated in computer science in 1997 and joined Microsoft, where he worked till 2010. Mr. Wong is now in charge of the Mi wifi and Mi Cloud teams.

Hong Feng holds a post-graduate degree in computer science. He started his career with Siebel System as a Lead Software Engineer. In 2006, Mr. Hong joined Google as a Senior Software Engineer. Later he also looked after the development of the various localized products of Google (in China) like Google Music and Google Pinyin Input as a Senior Product Manager at Google China. Mr. Hong now looks after the MIUI division at Xiaomi.

Xiaomi co-founder Chuan Wang is a seasoned entrepreneur. In 1997, Mr. Wang founded Thunderstone Technology, which grew to be the largest VOD (Video on Demand) system provider in China. In 2007 Chuan Wang founded a digital book company named Beijing Duokan Technology of which he is currently the CEO. In 2012, Mr. Wang joined Xiaomi as the co-founder and Vice President. Presently he manages the Mi TV and Mi Box teams at Xiaomi.

Flaunt your startup with StartupTalky

800+ stories, thousands of founders, and millions of visitors. Want to be the next?

StartupTalky is where founders, entrepreneurs, startups and businesses hang out and look up to for inspiration. If you have the means, we have the medium! Inviting founders and startups who are building sustainable solutions from ground zero! Startups who run the show, StartupTalky will let the world know!

Xiaomi - History

Lei Jun founded Xiaomi in 2010, as a software company and created MIUI ROM based on Google's Android. The idea behind developing MIUI was to offer more functionalities and a better UI than Android. MIUI indeed got the popularity it deserved. As per reports in March 2020, the MAU ( Monthly Active Users) of MIUI increased to 330.7 million worldwide.

In 2011 Xiaomi entered the hardware segment by launching the Mi One phone. The Xiaomi team's focus has been on creating quality hardware devices and sell them at comparatively lower costs than those available in the market while they intended to make revenue through their services and content. The company today not only sells mobile phones but much more like mobile apps, wearables, home appliances, and smart home devices.

Xiaomi - Name, Tagline & Logo

The meaning of the word ‘Xiaomi’ is ‘Millet’ and few reports show that it also means ‘Rice’. Lei Jun relates the word ‘Xiao’ to the Buddhist concept that, a single grain of rice is as great as a mountain’, indicating the company’s endurance. “Only for fans” was its tagline before.

The logo of the company shows the word ‘MI’- written in white placed inside an orange rectangle. ‘MI’ is the abbreviation for “Mobile Internet”, but Xiaomi has mentioned that it can also be read as “Mission Impossible”, representing all the challenges the company has faced so far.

Xiaomi - Funding & Investors

Xiaomi has raised funding worth approx. $7.4 Billion over 15 different funding rounds. Xiaomi went public in 2018.

Xiaomi - Competitors

Top competitors of Xiaomi include Samsung Electronics, Apple , Huawei , Samsung , OnePlus, and Oppo . Xiaomi sustains its paramount position with constant updates and optimization along with marketing at reasonable prices. Apple and Samsung provide good quality phones but have high prices. Whereas Xiaomi provides a number of features at reasonable prices.

Redmi smartphones are priced for as low as 6000 rupees on Amazon, and Xiaomi continues to have the highest market share for smartphone shipments in India. One of Xiaomi's strongest competitors is Realme. Realme is a daughter brand of Oppo also coming up with equally great phones like Xiaomi. And thus there is strong competition between Realme and Xiaomi. Motorola and Samsung are increasing the competition. Samsung released the M series where they actually did focus on value for money without compromising necessary specs.

Xiaomi - Revenue Model

Xiaomi’s primary source of revenue is from smartphones, the Internet of Things (IoT) and lifestyle products, internet services, and other miscellaneous products and services that the company offers.

A major portion of Xiaomi's revenue comes from the sale of smartphones. In 2018, the company is reported to have sold 119 million smartphones. Around 25% of Xiaomi's revenue comes from IoT and Lifestyle products. The company deals in a wide variety of IoT-enabled products like smart TVs, electric scooters, vacuum cleaners, cameras, rearview mirrors, etc. As regards the internet-based services provided by the company, pre-loaded apps and services form a good part of Xiaomi's revenue. Besides the company offers monthly subscriptions to its TV shows, games, and movies, and also earns by providing advertisement services.

Xiaomi - Growth & Revenue

Xiaomi has grown in sales and product ranges. The company reportedly has around 22,074 employees worldwide.

However, due to the Coronavirus pandemic, the smartphone company saw a decline in the Q1 of 2020. However, Xiaomi has also been declared as the only brand among the top five smartphone sellers , to achieve comparatively sound sales in the first quarter of 2020. It saw a 1.4% YoY from 2019, during the first quarter of 2020.

In 2019, Xiaomi’s total revenue was approximately RMB 205.84 Billion, and gross profit was nearly RMB 28.55 Billion. In the Q4 of 2019, the company’s total revenue grew by 27.1% to RMB 56.5 Billion with an attuned net profit of RMB 2.3 Billion and a 26.5% YoY increase.

“Despite headwinds from the Sino-US trade war and global economic downturn, Xiaomi stood out in 2019 with a commendable set of results as our revenue exceeded RMB 200 billion for the first time. We also celebrated several key milestones, ranging from the successful launch of our dual-brand strategy as Xiaomi and Redmi are spun-off and independently operated, the affirmation of ‘5G+AIoT’ as our strategic roadmap, to our inaugural entries into the prestigious ranks of the Fortune Global 500 and BrandZ’s Top 100 Most Valuable Global Brands” says, Mr. Lei Jun, Founder, Chairman, and CEO of Xiaomi.

According to reports dated September 1, 2021, Xiaomi has revealed that it would not be launching any more of its products with the Mi brand. The Chinese tech giant has decided to withdraw the "MI" name from all their future products.

Xiaomi - Future Plans

Xiaomi’s vision is to make quality technology accessible to everyone, i.e., “Innovation for everyone”. The company makes this possible with its high-quality products and remarkable services.

In 2020, Xiaomi intends to keep its focus on the development of 5G smartphones, and thus improve its position in the premium smartphone segment. The company also has plans to invest big in AIoT.

In the current scenario, where the Indian Government and the public at large are opposing China-made goods, Xiaomi India Head Manu Jain is quite optimistic about the company's position in India.

"We act like an Indian company since we have local productions. Data is stored in India as well. We have been trying to build a truly local company" - quotes Manu Jain

According to reports, Xiaomi has 7 factories in India, four of which are in Andhra Pradesh, two in Tamil Nadu and one in Noida. As claimed by the company about 99% of Xiaomi phones are produced in India. As said by Manu Jain, the company has also started a pilot project whereby the company is exporting Xiaomi phones made in India to Bangladesh and Nepal. Besides smartphones, the company claims that almost 100% of smartphone chargers, USB cables and batteries are made in India. Xiaomi also has a smart TV manufacturing plant in Tirupati, Andhra Pradesh.

With an aim to expand its business in India, MI increased its production capacities in the country by establishing 2 more factories to manufacture smartphones in India, and 1 factory dedicated entirely for the Smart TV division of the brand, as of February 2021.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Manage your business smoothly- Google Workspace

- International Money transfer- XE Money Transfer

Former Ola CBO Sidharth Shakdher Becomes CMO and Business Head at Paytm

According to reports, Sidharth Shakdher has been named the new Chief Marketing Officer (CMO) and Business Head of Paytm, a fintech company. Within nine months of joining the company run by Bhavish Aggarwal, Shakdher left Ola. Among other accomplishments, he was instrumental in the establishment of the consumer loans section,

Blinkit Launches Seller Hub to Facilitate Vendors' and Brands' Onboarding

In a LinkedIn post, Blinkit Chief Technology Officer Sajal Gupta announced the debut of Seller Hub, the seller programme for Zomato's rapid commerce platform, on October 23, 2024. This business structure is based on Fulfilled by Amazon (FBA), which is an e-commerce service offered by Amazon. Brands and

Uber Will Soon Test its Bus Service in Hyderabad and Mumbai

After Delhi and Kolkata, the ride-hailing app Uber plans to test its bus (shuttle) service in Hyderabad and Mumbai. The company is currently negotiating with a number of local stakeholders to obtain approval to launch in the nation's IT hub. In an interview with the media, Prabhjeet Singh,

Infosys and Meta Deepen Their Strategic Partnership to Promote Generative AI Innovation

The multinational technology company Meta and Infosys, a pioneer in next-generation digital services and consulting, bolstered their partnership on October 23, 2024, to promote generative AI innovation through open-source projects. Infosys is a firm believer in democratising AI and is a major supporter of open-source software. By utilising Meta'

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Xiaomi Redefined What It Means to Be a Platform

- Tony W. Tong,

- Yanting Guo,

Three factors enabled the electronics giant’s unique business model.

Traditional platform businesses generally fall into one of two categories: Ecosystems, such as Apple’s App Store, which offer limited resources to a wide array of independently-run firms; and Corporate Venture Capital (CVC) companies, such as Intel Capital, which invest heavily into a small number of ventures that promise either financial or strategic returns. However, new research into Xiaomi’s growth strategy suggests that the Beijing-based electronics giant has developed a blended approach, borrowing elements of both traditional ecosystem and CVC firms to create a broad ecosystem of strongly-supported partner ventures. Based on a series of in-depth interviews with executives from both Xiaomi and its partner companies, the authors identify three factors that have enabled this novel business model: Xiaomi structures its investments to incentivize innovation and build trust while still ensuring alignment, proactively fosters an ecosystem mindset throughout its organization, and takes a deliberate, measured approach to expanding the scope of its ecosystem over time.

From Apple to Amazon, Google to WeChat, digital platform-based ecosystems have become increasingly dominant in the last decade. However, while these businesses may all seem to follow similar models, there are in fact major differences between different types of platform companies.

- TT Tony W. Tong is a Professor of Strategy & Entrepreneurship and currently the Senior Associate Dean for Faculty and Research in the Leeds School of Business at the University of Colorado. He studies firm strategy, innovation management, and international business. He has published numerous top journal papers in these areas as well as multiple bestseller case studies in Harvard Business Publishing .

- YG Yanting Guo is an Assistant Professor in the School of Management at Xiamen University, China. Her research interests lie in technological catch-up, organizational capabilities, and innovation management. She has published articles in journals including Technological Forecasting and Social Change and IEEE Transactions on Engineering Management ; as well as several case studies in Harvard Business Publishing.

- LC Liang Chen is an Associate Professor of Strategic Management at the University of Melbourne. He is an expert on platform ecosystems and studies how firms engage in competition, innovation, and globalization in the digital economy. His research appears in Strategic Management Journal , Journal of Management , Journal of International Business Studies , and Harvard Business Review .

Partner Center

How Xiaomi is Dominating the Global Smartphone Market?

Just have a look around yourself, there must be at least 5 people around you who would be using a Xiaomi phone. Today, we will be talking about the leading smartphone brand who has been able to establish trust among users worldwide.

Let us first deep dive into Xiaomi’s journey-

Xiaomi Corporation is a Chinese electronic company founded in April 2010. The company began its operations as a software company by ex-Kingsoft CEO Lei Jun, by creating a new custom ROM based on Google’s Android, MIUI. The company launched Mi 1 and Mi 2 smartphones in August 2011 in and 2012 respectively in Asia and East Asia Markets.

In 2015, Xiaomi Corporation decided to expand its business in India through major e-commerce sites and offline retailers. Xiaomi was a ground-breaking smartphone at the time in budget and was well received by Indian customers. Since then, the company has expanded in Pakistan, Spain, UK, Ireland, Austria, Denmark, Sweden, Paris, Milan and the USA.

Besides smartphones, the corporation has also launched various smart home products, fitness products, TVs, laptops, drones, Wi-Fi routers, cloud services and instant messenger services.

Xiaomi Business Model

With the main aim of providing quality technology at affordable prices to everyone, Xiaomi has captured third place in the global smartphone market. Xiaomi’s Chief Executive Officer Lei Jun fragmented the source of revenue-generation into four segments of the market:

- Internet of Things (IoT) and lifestyle products

- Smartphones

- Internet services

- Miscellaneous services and products

As the years of success passed, the revenue generation process became faster and enterprise value touched $100 Billion during the initial public offering. The company began to compete with tech giants such as Apple and Samsung.

When Xiaomi was struggling to gain profit in 2016, the CEO decided to sell products other than smartphones. They generated substantial revenue that was enough to make a strong base for a large company. Besides selling smartphones, the company also provides services like air purifiers, suitcases, televisions and much more. Xiaomi also provides paid cloud storage. Services offered by Xiaomi also include online games and TV shows. Xiaomi is also producing AI-engines which can impact the business model positively in future.

Now, let’s have a look at different categories in which Xiaomi is ruling the technology market:

- Xiaomi’s Global Smartphone Market: In the present day, the smartphones of Xiaomi are responsible for 65% of the total revenue. According to a survey, Xiaomi sold 119 million smartphones in 2018. It is the highest number for any brand to date.

- Internet of Things and Lifestyle Products: Xiaomi has always focused on making people’s life simpler with its innovative technologies. Xiaomi’s IoT and lifestyle products roughly made 25 percent of revenue generation in 2018. It produced around $6.4 billion approximately. The products include internet cables, Bluetooth Speakers, Smart TV, Electric Scooters, Vacuum Cleaner, Cameras, Smart Home systems and much more.

- Internet Services: The business model of Xiaomi also includes internet service business. These businesses include preloaded apps and apps in the Mi store. Around 9.1 per cent of the total revenue comes from these services. They also provide cloud storage which is again a paid service. Xiaomi always focused on its internet services. Its efficient internet services are for start-ups. Start-ups play a crucial role in Xiaomi’s success in terms of business.

Xiaomi’s Revenue Generation Model:

With ensuring better productivity at an affordable price, Xiaomi focuses on its customer acquisition and advertising strategy. The business model of Xiaomi includes a variety of electronic gadgets and internet services that are innovative and attractive. Miscellaneous additional services and products of Xiaomi also have their fair share in helping the company generate good revenues.

Customer reliability is one of the critical strengths of Xiaomi. Xiaomi always produces affordable products. This thing still fascinates the customer towards the brand. Xiaomi provides its users with an unforgettable experience which also helps them to retain their customer base. This lets the company have more subscribers for its proprietary services such as Mi Store, Music, MI Cloud and so on. All this helps the company make good money.

Marketing Approach adopted by Xiaomi:

Xiaomi has kept its marketing strategy minimalistic due to the cost leadership business strategy. Unlike other recent competitors like Oppo and Vivo, the mobile internet company didn’t adopt traditional marketing and utilised social media marketing to save on advertising costs.

Xiaomi adopted hunger marketing as an integral part of their digital marketing strategies. The company operated according to the emotional needs of their target customer segment by creating a shortage of supply in purpose, creating a buzz in the market and evoking desire in customers to own an MI smartphone.

Xiaomi focused primarily on the price element of the marketing mix compared to other elements of the 7P’s of marketing. Let us check out those 7Ps of marketing: Product: The mobile internet company offered high-quality phones with latest features at unbelievable prices. The product consisted of high-quality hardware components and the final price was very low when compared to other brands.

- Pricing: The product was sold on its cost price through online platforms without involvement of any mediator.

- Place: After the huge success in China, Xiaomi launched its products internationally. They hired Hugo Barra (Ex-Google android Executive) to discover new opportunities for expansion.

- Promotion by Social Media: Xiaomi leveraged social media platforms beautifully to enhance their online presence. Engineers engaged with consumers and gathered feedback to refine the software and remove the bugs.

- Promotion by Brand Promoters: Xiaomi actively participates in the discussion on social media has succeeded in generating a dedicated fan base of millions of users. Promotion by Word of Mouth: The Flash sales created a buzz and everyone was talking about it. It helped Xiaomi to gather huge popularity.

- Promotion by CEO: Xiaomi’s head, Lei Jun, did a great job in making his brand look cool. He put a face to the brand. Lei Jen’s is quite similar to Steve Jobs in the way he talks about the brand.

Social Media Strategy adopted by Xiaomi

Leveraging the power of social media marketing, the Chinese mobile internet company didn’t invest a single penny in traditional advertising. The company employed 2000 people over social media and online forums to manage its online community. Xiaomi followed a well-strategized plan to expand its online presence:

- Building a strong tech fan base: Starting the company with a single product that was MIUI operating system, Lei Jun was not in the mood to spend money on advertising and marketing in the beginning phase. To create brand awareness, he with his team started to promote his product on online forums. They all worked very hard and spent a lot of time on forums, making comments, sending posts and advertising. They used the above method to do marketing with zero budget, they set up MIUI mobile phone forum, which became the base camp of “mi fan” with over 1 million registered users.

- Gaining the trust of the fan base: Xiaomi started to collect feedback from its users every week and implement it in the next release. Every week, a new version of MIUI was released which was again then analysed by a few hundred thousand hardcore users. Some of the users participated in product research, development, test, spread, marketing and public relation. Fans also organized offline city gatherings.

- Selling directly to your fans and Promote your brand’s name: Naturally, the 1 million “mi fan” users became the first buyers of MIUI smartphones. People bought the phones, liked it and recommended it to other users. The company now uses Flipkart, Amazon and offline stores as Point of Sale.

Campaigns by Xiaomi

Social media marketing is a very effective and reliable source for any brand, product which is going to be launched. If social media marketing is used with a proper plan and strategy then we can see a huge difference in traffic and terms of revenue. To connect with the customers, attract engagement and build the presence of the brand online, Xiaomi developed various social media campaigns. Let’s have a look into them.

#MiIndia – A Social Media Campaign on Twitter by Mi India To attract new buyers for Mi 3 (the newly launched Smartphone by Mi India in July 2014), the brand connected with people on Twitter use the hashtag #MiIndia. Users were asked to show their interest in the Smartphone and register themselves on the official website. One lucky winner would win a power bank from Mi India.

#GuessTheCup- A Social Media Campaign on Facebook by Mi India To promote the Mi Bands, the brand connected with people across Facebook with a contest. The users were asked to guess the cup under which the band was present in a video uploaded. The lucky winners would get a chance to win bands from Mi India.

Redmi Note– A Social Media Campaign through Twitter by Mi India Mi India connected with people on Twitter to promote their new Redmi Note phone and convinced them to participate in the contest. The users were asked to follow the brand and re-tweet the official launch tweet for Redmi Note. 10 lucky winners would win priority passes for the grand launch of the Smartphone.To amplify the effect, Xiaomi debuted television with its first ever TVC for the Indian market in 2015. The ad film promoted its newest offering- Redmi Note 3.

#Shot on RedmiNote7s On Instagram, the camera quality of the Mi phones was explored and promoted in the best way. Xiaomi relied on Social media to engage with Mi fans, consumers and used the platform to share thoughts, converse with like-minded people and generate high-quality content.#ShotOnRedmi helped communicate the value of a phone for a potential consumer and also helped in retaining followers for the brand.

Note Kiya Jaye – #RedmiNote7Pro With the launch of Note 7 Pro, Xiaomi launched a new campaign “Note Kiya Jaye” that featured their new brand endorser, Ranveer Singh who had the power to play multiple characters with his strong comical tone. Note Kiya Jaye effortlessly played out humorous scenarios while showcasing the features of the phone and innovative technology for customers.Xiaomi left no stone unturned to promote its product. They used 360 degree marketing strategy slowly and steadily. They have also conducted several influencer marketing campaigns to promote its product among the youth.

- DurSeDekho- Redmi Note 7 Pro In the classroom scene, the Father (Ranveer Singh) while casually inspecting the classroom environment uses the double-tap double-zoom feature on Redmi Note 7 Pro’s 48MP camera to zoom into the student’s desk to find that he is reading a comic book instead of a textbook.

Key Takeaways from Xiaomi’s Business Strategy

Xiaomi’s business strategy depends upon time and trends. Here are some key-takeaways from the strategy that we must study and implement to further growth:

- Assembling and Employing a fan base: Since 2012, the brand has created a huge fan base that involves millions of people across the world. Fans spend countless hours online discussing Xiaomi products on various forums which increased the level of brand awareness at no extra cost to the company. Just like Apple, every mobile company enjoys a hardcore following.

- Manufacturing Exceptional Products at Pocket-friendly services: With the aim of providing people with exceptional products at pocket-friendly prices, Xiaomi with MIUI interface created a practical design with their latest technology, By providing exceptional technology, they have also targeted the lower-income group. They can buy these smartphones easily. Xiaomi mainly competes with the market on providing cheap products and services.

- Regular Optimizing of Products and Services: The mobile company is actively developing the ecosystem for its products and services. Xiaomi’s business strategy attracts business from 55 companies of which 29 companies were originally started by Xiaomi itself. Besides manufacturing smartphones, Xiaomi also deals in various products ranging from gaming laptops to homemaking products.

- Large Community and Social Media Engagement: With more than 1 Million monthly users, MI community has become a strong platform to interact with the Mi users. When compared to other brands, some of the biggest tech giants do not provide a common platform to share their views. The tech giant also invites its fans for its launch of any new product. Xiaomi also does its engaging part with the users on the other social media platforms and remains active with them.

- Flash Sales: Xiaomi builds its market by creating a demand for its newly launched product. People get the Fear of Missing Out (FOMO) and eventually end up discussing when the next sale goes on. This leads to curiosity and free promotion. This type of marketing strategy is called hunger marketing.

- Beta Access to Gadgets: To create a hype in the market, Xiaomi chooses a limited number of beta users which can be up to 500. They can buy gadgets for less selling price and loyalty points before its ahead of the official launch. Xiaomi teased its MiPad in May, selected Xiaomi fans got hold of the Android-based tablet a few weeks before it hit Xiaomi’s online sales.The strategy used created hype and enhanced word-of-mouth advertising. It’s usually a period when newly-revealed gadgets drop off the radars of most gadget enthusiasts.

Conclusion Truly, Xiaomi is a perfect example of a start-up business. It has been a unique blend of business strategies, digital marketing strategies and social media marketing strategies which has transformed the business in just 5 years of its inception. Cost competitive strategies have been boon for the brand. There are opportunities for Xiaomi to become the world’s No. 1 smartphone company as the company is already giving a tough competition to other competitors.

Experential

What marketing strategy helped Xiaomi lead the Indian smartphone market

The smartphone market in India is one of the most competitive markets in the country. Both local and international brands fight hard to position themselves in India, as the country is still developing and has a comparatively lower smartphone penetration than developed countries like the US, UK, or the European market.

The number of smartphone users in India is expected to be over 760 million in 2021 according to Statista, depicting the importance of these devices in our daily lives. From Mukesh Ambani down to your nearest chai-wala, everyone can be seen flaunting one. This number is fuelled further by the penetration of the internet in the rural areas, and the coronavirus pandemic shifting business meetings and classes online.

When we talk about buying smartphones in India, one brand that definitely comes to mind is Xiaomi. Almost every second person would be using a Xiaomi phone so much so that in a crowded space, when a phone rings, one would not be able to distinguish their phones from others, because of the familiar Xiaomi ringtone. We have all seen the famous “Kiska baja” ads by the company.

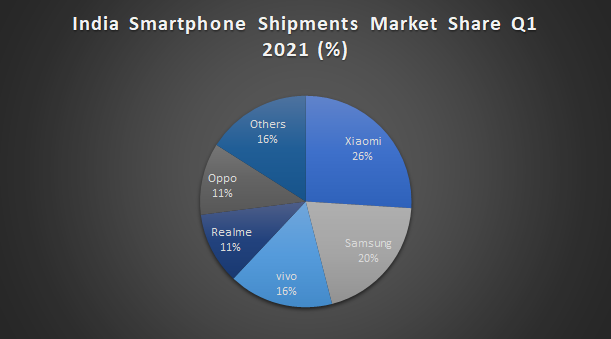

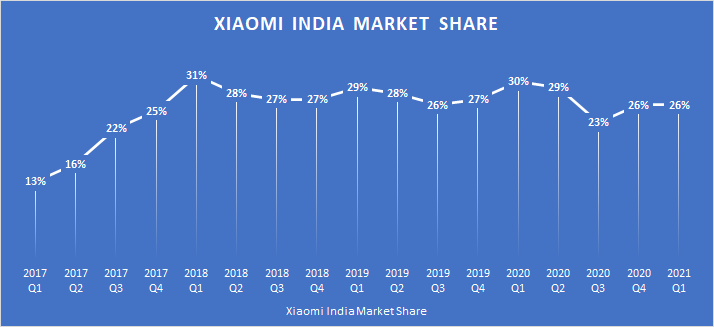

The Chinese player, which has led the Indian smartphone market for three consecutive years, has a whopping 26% of market share as of Q1 of 2021, compared to the 20% market share captured by its long-rival, Samsung. That’s a steep rise for a company that had just 3% of the market in 2015. All thanks to the innovative marketing strategy of Xiaomi that stimulated this growth.

Regulatory filing access by AltInfo showed that Xiaomi posted a profit of Rs 401 crore in FY20 after sustaining Rs 148 crore loss a year earlier. In FY20 Xiaomi India clocked revenue of 38,196 crore which is roughly 13.5% of its global revenue of 2,82,000 crore .

Fun Fact: It’s a very famous fact that Xiaomi owns Mi and Redmi but do you know that there is an unknown Chinese company that owns OPPO, VIVO. OnePlus, Realme- BBK Electronics. If we combine their market share it’s actually BBK Electronics that rules the Indian smartphone market. What strategy did BBK Electronics use to rule the Indian smartphone market?

In this article, we will explore the marketing strategies that Xiaomi deployed to get to the top of the table

Understanding the demand of customers.

The consumer needs in India are different from that of their western counterparts. What works in global markets, may not work in India. Xiaomi sells about 200+ products in China, while in India, the count is about 20+ products. The company has established a dedicated R&D center in Bangalore to specifically cater to Indian consumers.

View this post on Instagram A post shared by Xiaomi India (@xiaomiindia)

The price elasticity of demand is high which means that consumers here are sensitive to pricing. Smartphones had not been able to reach the masses due to their high prices before the entry of affordable smartphones. Mr. Manu Kumar Jain , the CEO of Xiaomi India, identified this as a potential and aimed to make its foot stronger in the Indian market by targeting people who have been untouched by the telecom revolution, amidst the explosion of the Internet .

The tech giant’s mission statement, thus, came to be-

“At Xiaomi, we strive to create the highest quality products at the lowest possible prices to provide people with access to the necessary tools and services that connect them to the world and, ultimately, their dreams.”

Ever used a smartphone for more than 2 years? I don’t think so.

Over 52% of the smartphone users in India changed their primary smartphones after at least 2 years of use. 26.9% upgraded their phones within 1-2 years of use. The primary reason is to own the latest or a better smartphone. Xiaomi capitalized on this fickle behavior by frequently launching new products with new features.

Understanding the market and competition

Xiaomi surveyed the Indian market and carefully analyzed the competitive strategies used by Apple and Samsung. It concluded that both the brands had a loyal fan base and a robust operating system-iOS and Android, respectively. It picked up on these conclusions and started designing its own custom UI known as MIUI-based on Android.

In order to compete with the likes of Samsung, Apple, OnePlus, Xiaomi had to constantly work on improving its product. This was done by collecting feedback from users and incorporating it in the next higher version.

Mi fans, calling out all our #RedmiNote8Pro , #RedmiNote7Pro , #RedmiNote7 & #RedmiNote7S users to become a part of pilot testing of #MIUI12 . Let us come together & make #MIUI better for everyone. Apply now: https://t.co/xjWP1qECOJ RT to spread the word. pic.twitter.com/THs8e4jWJg — MIUI India (@MIUI_India) June 12, 2020

Once, Xiaomi was through with its OS, the next big task was to acquire early users. However, it didn’t want to spend huge amounts of money on advertising. Rather, the company wanted to build brand awareness by creating a loyal fan base.

So how did Xiaomi do it?

The company employed people to manage its social media and online forums. This team began engaging with the community. Their efforts proved fruitful the day Xiaomi launched the Mi 3 and the Flipkart website crashed in a matter of seconds!

Apart from this, Xiaomi also runs a lot of campaigns on social media to promote its smartphones and made effective use of word-of-mouth advertising.

#MiFans , Celebrate this friendship day with #Mi . 👬 Here's your favorite #Mi11XSeries at an amazing price. Now save up to ₹13,000. Come celebrate this friendship day with us at: https://t.co/xDxXUdlTnZ pic.twitter.com/Kbw9l2Ge7Q — Mi India (@XiaomiIndia) July 31, 2021

#MiFans , get the best deals on your favourite #Mi Smartphones Up to ₹4,000 off on exchange and ₹3,000 Instant Discount and more 🤩 Head now to https://t.co/D3b3QtmvaT , @amazonIN and shop yours today! pic.twitter.com/WopVPbFR8C — Mi India (@XiaomiIndia) July 29, 2021

Another reason for Xiaomi’s success was the slow collapse of India’s home-grown mobile brands due to the lack of 4G capability. There was a time when we saw Indian players like Micromax leading the market, but things took a drastic turn around 2016-17 when 4G was introduced in India.

By the time 4G had arrived in India, Chinese companies had already managed to successfully outfit cheap phones with 4G technology and were selling them back home! This made it easier for Xiaomi to transition phones from 3G to 4G overnight in India, ultimately killing the Indian brands that failed to adapt quickly.

Quality products at affordable prices

Xiaomi phones rate high on the value-for-money factor that they provide. They come power-packed with features and hardware that make Indians feel that they were getting more bang for their buck. Its flagship Redmi range of phones, for instance, typically start at Rs. 9,999/- rupees and goes up to Rs. 19,999/-.

Penetration pricing is a pricing strategy where the price of a product is initially set low to rapidly reach a wide fraction of the market and initiate word of mouth. The strategy works on the expectation that customers will switch to the new brand because of the lower price.

The way the company used penetration pricing helps explain their popularity in India-consumers were getting better features than before at rock bottom prices. In order to further cut costs, the company started to assemble its products locally in India to take advantage of the Make in India duty benefits.

Here is a review article by Gadgets 360 that has rated Xiaomi’s Redmi Note 10 an overall 9 out of 10 for value for money.

Xiaomi is basically an e-commerce company

Xiaomi largely sells its phones online and does not invest a lot in building an offline presence in the form of a traditional brick and motor retail store. In the Indian context, although it operates its own website to sell its products, Xiaomi also partnered with the biggest e-commerce platforms-Flipkart and Amazon to tap into their strong distribution channels.

This way, the company did not have to incur unnecessary capital expenditure and at the same time, making sure that their products reached the maximum number of smartphone lovers. A simple, yet effective move!

Creating Scarcity

Xiaomi’s flash sales help it reduce inventory costs and overproduction disasters. It is an exciting marketing strategy where Xiaomi uses discounts, time limits, and limited stocks as tactics to fascinate the customers.

While that makes it harder to get your hands on a new Xiaomi device, the company has managed to spin that into a positive, creating periodic hype as flash sales of a limited number of devices open up every week. Although the scarcity of a product results in disappointment, it nevertheless increases the value of the product by enticing the customers to buy it by invoking a feeling of FOMO.

We heard you! India's all-rounder Redmi Note 5 will go on sale at noon on https://t.co/cwYEXdVQIo & @Flipkart . #GiveMe5 pic.twitter.com/Yfqpp1CCS7 — Redmi India – #RedmiBook Super Start Life (@RedmiIndia) March 16, 2018

Once a flash sale is completed, Xiaomi makes use of the quick sell-out in further social media postings, to grab more eyeballs. This is known as hunger marketing. Competitors including OnePlus and Realme have also started using flash sales.

Hunger marketing is a marketing strategy especially focusing on the emotions of human beings. Hunger marketing is a psychological strategy that focuses on the desire of consumers, making them hungry thus having a strong desire to buy products that other people also want to buy.

The Way Forward

Xiaomi’s share of the market has not been able to grow much beyond the 26-27% mark, signaling a plateau. The Korean tech company, Samsung is inching close behind; and newer brands like Realme have started to gain the limelight.

This could explain why Xiaomi is testing waters in the premium smartphone market, with the launch of a new range of phones called the K-20 series.

“A few years ago, the premium market was about three to four percent of the Indian smartphone market. This has now grown.” Xiaomi India’s director, Manu Jain, said in an interview with the Hindu newspaper. He also added that the company had set its sights beyond the affordable smartphone market.

Most recently the Mi 11 series graced this list with much hue and cry. In the advertisement below you will notice a premium feel. Xiaomi has customized its marketing strategy and market positioning for the premium market.

Xiaomi will need to keep pushing its limits and continuously evolve its marketing strategy in India, given that the competition remains fierce and no company has dominated it for too long.

#Mi11 Series: An outstanding ‘Trend-setter’ 😍 1 year ago many didn't believe when we started our premium journey. Today #Mi11Series is ~25% more searched than biggest competition. 🙏 #Mi11Ultra , #Mi11XPro , #Mi11X , #Mi11Lite : all huge success!✌️ Thank you all. I ❤️ #Mi #Xiaomi pic.twitter.com/9mlmMCpNRD — Manu Kumar Jain (@manukumarjain) July 30, 2021

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below