- Certifications & Affiliations

- Knowledge Center

- Medical Records Release Form

- ImageSilo Digital Repository

Records Management

Records Management 101: Why Is It Important?

Now, more than ever, it’s critical for organizations to have an effective records management program in place. As the creation of infinite amounts of information continues to increase and regulatory laws evolve, the need for records management becomes only more imperative.

While many companies are familiar with the concept of records management for paper records, many are still not addressing the management of huge volumes of electronic documents. Business leaders need to understand the importance of managing all types of files – including both physical and electronic – to stay compliant. Additionally, they need to understand how implementing a comprehensive RIM program can help their organization reach long-term goals.

What Is Records Management?

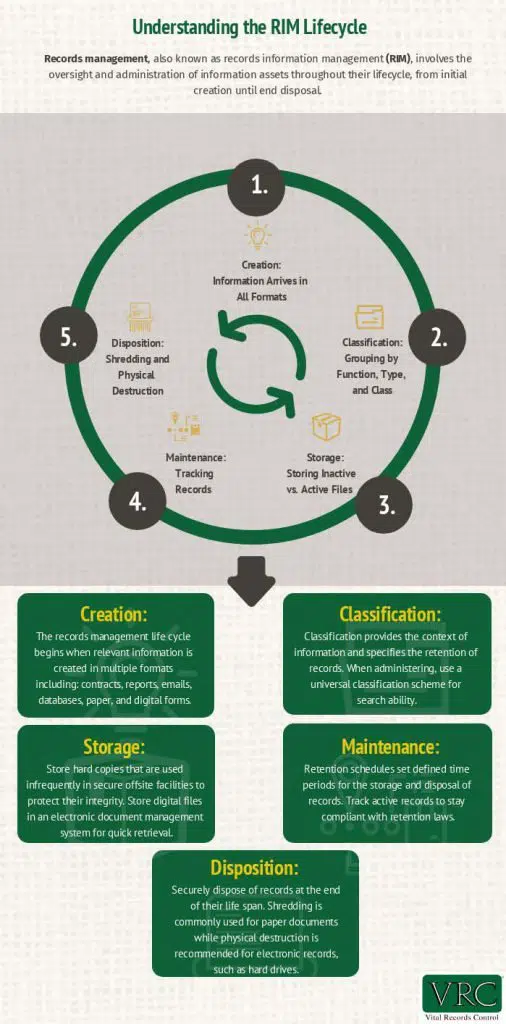

Records management , also known as records information management (RIM) , is the process of supervising and administering information created, received, maintained, stored and disposed of, regardless of format. Simply put, records management is the management of an organization’s information throughout its lifecycle. Companies must follow approved policies, records management procedures , and retention schedules when creating, maintaining and sharing information.

The RIM life-cycle accounts for the management of all paper and digital files, including personnel files, financial reports, emails, social media and more:

Why Is Records Management Important?

According to IBM, 90% of the world’s data was created in two years alone. Without the regular monitoring of your information, the management of massive volumes of data becomes nearly impossible.

In addition to data overload, the ever-evolving regulatory environment is a reason why records management is imperative for companies. Unenforced records management procedures and retention policies can result in unnecessary audits, lost productivity, and hefty penalties for noncompliance.

A comprehensive RIM program manages the growth of information over multiple repositories, keeping you in compliance with data privacy regulations for information governance (IG) and e-discovery . The following are extended benefits of implementing a good records management plan in your office:

Benefits of Records Management for Businesses

1) reduces records volume and storage costs.

Did you know that only 5-10% of business records have any significant value? Imagine the number of files, reports, and emails that are produced by your organization on a daily basis. Out of all that information, only a portion of it may be useful or necessary to keep.

With the proper management of records, an organization controls the growth of records and retains only relevant data. A RIM system follows a mandated retention schedule, outlining how long records need to be kept and when disposition needs to occur. Paper documents that are legally required to be stored can be stored cost-effectively with the help of document storage companies . Files that are accessed daily can be scanned and stored in an electronic document management system, opening up office space that can be reallocated to other business functions.

2) Allows Effective Retrieval of Records

Information is only useful when it can be retrieved. RIM accounts for the quick retrieval of documents by indexing and organizing them—making them accessible and reducing employee search times.

By scanning documents into an advanced document management system , information can be gained quickly and accurately from a cloud-based repository. Data can be shared and updated remotely, eliminating unnecessary duplicates. With accessible information at hand, your organization is enabled to make smarter, better business decisions.

3) Enables Regulatory Compliance

With records management laws t(including HIPAA, FACTA, and the HITECH Act), the need for a well-structured records management system in business is paramount. Enforcement for noncompliance can be severe, including subpoenas, legal actions, and costly penalties.

Whether you have a paper or electronic records management system, it’s essential to track records throughout their lifecycle as evidence of their existence. The tracking of records permits your staff to know when and how to apply retention rules, such as legal hold or destruction.

4) Enables Business Continuity

Ensuring the preservation of your company’s assets is a critical component of an effective RIM program. Information delivers value to each part of your organization, and, if permanently lost, your business could suffer drastically.

Adopting a records management policy keeps sensitive data protected in the event of an emergency or natural disaster. Electronic records and data backups that are essential to continuity can be stored in secure media vaults , protecting them from internal or external threats.

5) Automates Workflow

Most companies don’t analyze the time employees spend on storing or searching for records. When documents are stored onsite and disorganized, you must constantly sift through them to locate relevant information. After retrieval, you must undergo an additional refiling process.

With a unified records management system, content is stored in a centralized repository. Records are classified and categorized, cutting down on retrieval times and accelerating your organization’s ability to conduct business.

A Customized RIM Program for Your Business

A RIM program requires a well-organized, consistent plan of action structured around your long-term goals. At Vital Records Control (VRC), we aren’t only a document storage provider; we’re your partner to manage all your information assets throughout their entire lifecycle. Our team meets with you to understand your long-term objectives, customizing a RIM strategy that’s suited for you. Get in touch with us to learn more.

Related Resources

Cybersecurity Awareness Month: Vital Trends for Business Security

A Clean Start: Purge Shredding for Tax Season

Benefits of Purge Shredding for Small Businesses

Get in touch with us..

See how we can help protect your records and documents throughout their life cycle.

Privacy Overview

IMAGES

VIDEO