16 research papers every VC should know

Posted by Shaun Gold | October 10, 2022

Understanding venture capital is more than reading decks and tweaking your fund’s investment thesis. It requires an edge that comes from knowledge. Here are thirteen of the best research papers on VC to help you obtain that edge.

Table of Contents

1. many of the largest u.s. companies owe a vc.

VC powers the U.S. economy

Will Gornall (University of British Columbia (UBC) - Sauder School of Business) and Ilya A. Strebulaev (Stanford University - Graduate School of Business; National Bureau of Economic Research) showcase that Venture capital-backed companies account for 41% of total US market capitalization and 62% of US public companies’ R&D spending. Among public companies founded within the last fifty years, VC-backed companies account for half in number, three quarters by value, and more than 92% of R&D spending and patent value. This only transpired after the 1970s ERISA reforms. The paper further shows that US VC industry is causally responsible for the rise of one-fifth of the current largest 300 US public companies and that three-quarters of the largest US VC-backed companies would not have existed or achieved their current scale without an active VC industry.

2. Geographic Concentration of VC Investors in a Syndicate is Correlated to Deal Structure, Board Representation, Follow-On Rounds, and Exit Performance

Geographic concentration of venture capital investors, corporate monitoring, and firm performance.

A May 2019 Dartmouth paper by Jun-Koo Kang, Yingxiang Li, and Seungjoon Oh finds that compared to VC investors that are geographically dispersed, those that are geographically concentrated use less intensive staged financing and fewer convertible securities in their investments, are less likely to have board representation in their portfolio firms, and are more likely to form successive syndicates in follow-up rounds. Moreover, their firms experience a greater likelihood of successful exits, lower IPO underpricing, and higher IPO valuation.

3. VC firms that lack diversity perform 11%-30% lower on average

VC firms that lack diversity pay a higher cost

A 2017 paper from Paul A. Gompers and Sophie Q. Wang of Harvard documents the patterns of labor market participation by women and ethnic minorities in venture capital firms and as founders of venture capital-backed startups. If the partners of the VC firm are from the same school, the fund has a lower performance of 11%. If the partners have the same ethnicity, the fund has a lower performance of 30%. If the fund is all men, there is a 20% lower performance.

4. Venture Capital infusion harms non-VC backed industries in communities

The Silicon Valley Syndrome

A 2019 paper from Doris Kwon and Olav Sorenson of Yale University demonstrates that an infusion of venture capital in a region actually is more harmful than beneficial. The paper illustrates that VC infusion in a region is associated with declines in entrepreneurship, employment, and average incomes in other industries in the tradable sector while at the same time an increase in entrepreneurship and employment in the non-tradable sector and income equality overall in the region.

For example, the boom of Silicon Valley caused real estate prices in the Bay Area to rise which priced out low-salaried workers in the non technology sector. This caused other firms to lose talent to a handful of Silicon Valley technology companies. This is similar to the Netherlands in the 1960s after the discovery of natural gas which led to booming petroleum exports and the value of the Dutch currency to rise. Yet this also caused harm to other firms due to rising operating costs and to them losing workers to the natural gas extraction industry. The economy was left more vulnerable overall.This became known as “Dutch Disease.”

5. VC’s who’ve been fortunate to succeed once keep succeeding as initial success brings them quality deal flow

The persistent effect of initial success

A 2019 paper from Sampsa Samila (IESE Business School), Olav Sorenson (Yale), and Ramana Nanda (Harvard) illustrated that each additional initial public offering (IPO) among a VC firm’s first ten investments predicts as much as an 8% higher IPO rate on its subsequent investments, though this effect erodes with time. Successful outcomes result in large part from investing in the right places at the right times; VC firms do not persist in their ability to choose the right places and times to invest; but early success does lead to investing in later rounds and in larger syndicates. This pattern of results seems most consistent with the idea that initial success improves access to deal flow. That preferential access raises the quality of subsequent investments, perpetuating performance differences in initial investments. What does all this mean?

Get lucky once and everyone thinks you have the right stuff which results in more opportunities and quality deal flow.

6. Half of VC investments are predictably bad—based on information known at the time of investment

Predictably Bad Investments: Evidence from Venture Capitalists

Diag Davenport of the University of Chicago Booth School of Business argued in a 2022 paper that institutional investors fail to invest efficiently. By combining a novel dataset of over 16,000 startups (representing over $9 billion in investments) with machine learning methods to evaluate the decisions of early-stage investors, Davenport showed that approximately half of the investments were predictably bad. This was based on information known at the time of investment and that the predicted return of the investment was less than readily available outside options. Suggestive evidence also illustrated that an over-reliance on the founders’ background is one mechanism underlying these choices. The results suggest that high stakes and firm sophistication are not sufficient for efficient use of information in capital allocation decisions.

7. Getting funded by a reputable VC with a strong brand adds a lot of value

This paper by Darden pressor Ting Xu, Shai Bernstein of Harvard Business School, Kunal Mehta of AngelList LLC, and Richard Townsend of the University of California, San Diego analyzed a field experiment conducted on AngelList Talent. During the experiment, AngelList randomly informed job seekers of whether a startup was funded by a top-tier investor and/or was funded recently. Startups received more interest when information about top-tier investors was provided. Information that included the most recent funding amount had no effect. The effect of top-tier investors is not driven by low-quality candidates and is stronger for earlier-stage startups. Essentially, the potential employees cared about who funded it and not the amount. The results demonstrated that venture capitalists can add value passively, simply by attaching their names to startups.

8. VCs invest in the team rather than the product or technology

How do venture capitalists make decisions?

This paper was written by a rockstar team composed of Steven Kaplan, Neubauer Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business and Kessenich E.P. Faculty Director of the Polsky Center, along with Paul Gompers at Harvard University Graduate School of Business; Will Gornall at the Sauder School of Business at the University of British Columbia; and Ilya Strebulaev at the Stanford University Graduate School of Business. They surveyed 885 institutional venture capitalists at 681 firms about practices in pre-investment screening, structuring investments, and post-investment monitoring and advising. The results showed that VCs see the management team as somewhat more important than business-related characteristics such as product or technology. VCs also view the team as more important than the business to the ultimate success or failure of their investments. The VCs rated deal selection as the most important factor contributing to value creation, more than deal sourcing or post-investment advising.

9. VC has real limitations in its ability to advance substantial technological change

Venture Capital’s Role in Financing Innovation: What We Know and How Much We Still Need to Learn

In this paper, Harvard professors Josh Lerner and Ramana Nanda argue that despite the growth VC brings into technology companies, there remain real limitations in regard to technological change. They are concerned about the very narrow band of technological innovations that fit the requirements of institutional venture capital investors; the relatively small number of venture capital investors who hold and shape the direction of a substantial fraction of capital that is deployed into financing radical technological change; and the relaxation in recent years of the intense emphasis on corporate governance by venture capital firms. They believe this may have ongoing and detrimental effects on the rate and direction of innovation in the broader economy.

10. More collaborative experience among VCs leads to M&A while less leads to an IPO

The Past Is Prologue? Venture-Capital Syndicates’ Collaborative Experience and Start-Up Exits

Dan Wang of Columbia, Emily Cox Pahnke of the University of Washington, and Rory McDonald of Harvard argue that as prior collaborative experience within a group of VCs increases, a jointly funded start-up is more likely to exit by acquisition (which they call a focused success); with less prior experience among the group of VCs, a jointly funded start-up is more likely to exit by initial public offering (which they term a broadcast success). This tested their hypotheses using data from Crunchbase on a sample of almost 11,000 U.S. start-ups backed by venture-capital (VC) firms, using the VCs’ previous collaborative experience to predict the type of success that the start-ups will experience.

11. Solo-founded startups are strongly associated with more rapid growth to unicorn status

In a paper by Greg Fisher, Suresh Kotha, and S. Joseph Chin, startups that have reached unicorn status are thoroughly examined. This is done through prior research on growth and valuation of unicorns as well as examining the dynamics to view the variations in which they reach a billion dollars in valuation. Ultimately, the paper demonstrates that the founder's age, gender, and affiliation with the Ivy League were not significantly related to the growth of unicorns. Furthermore, solo-founded startups are more associated with rapid growth to a unicorn valuation.

12. Warm introductions lead to 13x higher chance of funding

UK Venture Capital and Female Founders Report

Alice Hu Wagner, Calum Paterson, and Francesca Warner illustrate that startup decks that come in warm are far more likely to get funded. This rewards founders who have a great network and are connected but harms the multitude who lack these connections. If founders lack a network of investors, bankers, angels and other founders, fewer will be able to reach a proper VC.

13. Venture capitalists should stay in their lane

Venture capitalists are specialists.

Tyler J. Hull argues that VC performance is much better in the sub-industry they focus on rather than sub-industries where they have limited experience. And they underperform more the further outside their focus they go. Co-investing with another venture capitalist that has the same investment focus as the investment firm partially mitigates this effect. Additionally, the negative effect is shown to be more pronounced the greater the degree of difference between the venture capital’s preferred investment industry and the investment industry.

In other words, VCs should stay in their lane and make investments in their area of focus.

14. Data makes all the difference

Hatcher+ and need for data driven forecasting.

Hatcher+ is a globally diversified, multi-sector, early-stage technology investment fund founded in 2018. Based in Singapore, the managers use a combination of data science, modeling, workflow automation, and machine learning to execute a global venture investment strategy capable of unprecedented scale in terms of the number of investments. As a result, they produced a paper on venture capital transaction history to define and refine its approach to early stage investing. Via their own research, they discovered that data quality is actionable for a data-driven VC firm, accelerator rounds provide a strong opportunity for investment, deal flow is essential (especially for firms with large portfolios), large portfolios with follow on increases viability and adds round diversification, and that larger portfolios by investment count are key to early stage success.

15. Founders can become VCs but that doesn’t guarantee success

Success and failure as a founder plays a role if a founder becomes a VC

Paul A. Gompers & Vladimir Mukharlyamov explore whether or not the experience as a founder of a venture capital-backed startup influences the performance of founders who become venture capitalists. They discovered that almost 7% of VCs were previously founders of a venture-backed startup. Having a successful exit (an acquisition or IPO) as well as being male and white increased the probability that a founder transitioned into a career in VC. Successful founder-VCs have investment success rates that are 6.5 percentage points higher than professional VCs while unsuccessful founder-VCs have investment success rates that are 4 percentage points lower than professional VCs. The primary benefit of a founder-VC is not deal flow but the value add that they provide to their portfolio companies.

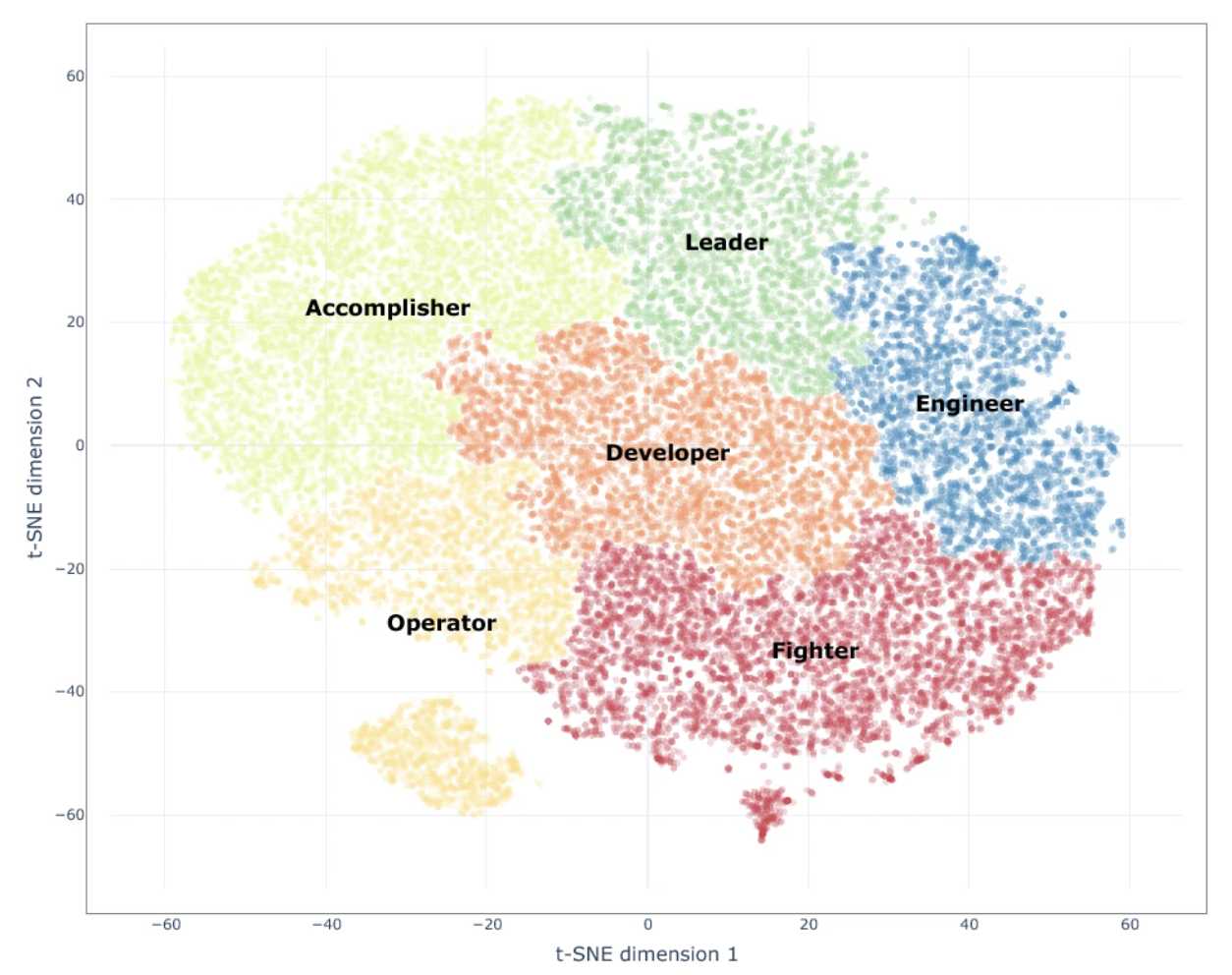

16. Successful founders have similar personality traits

The impact of founder personalities on startup success

Paul McCarty et alii. ran a large-scale study over 21,000 startups worldwide and found that personality traits of startup founders differ from that of the population at large. Successful entrepreneurs show high openness to adventure, like being the centre of attention, have higher activity levels. Six different personality types appear for founders: Accomplisher, Leader, Operator, Developer, Engineer, Fighter.

Venture capital is still a young industry and has more bragging rights than most realize. By effectively reading the research conducted by some of the leading academics at top universities, you can give yourself an edge and competitive advantage. This doesn’t cost but I promise you that it will pay.

Did we miss a great research paper that you think VCs should add to their arsenal of knowledge? Email me at [email protected] and I will add it.

OpenVC is the best way to access deals 🤝

Browse the top 1% of deals and interact directly with founders. Completely free.

OpenVC is a radically open platform that helps tech founders connect with the right investors.

POPULAR Posts

How to value a startup: 9 best methods for 2025

How to Model a Venture Capital Fund

12 Best Startup Financial Model Templates [Free & Paid]

How to raise funds with cold emails

Pitch deck for startups - 9 templates compared

An LP take on VC portfolio construction

How to whitelist OpenVC

You might also enjoy

Why Seed Funding Is a Pool Party

You might think you’re fundraising, but what you’re actually doing is throwing a pool party. Venture funding dynamics in the Seed Phase have evolved differently than venture capital at Series A and beyond. A Seed fund would almost never take the whole round, even if it could.

Launching a VC fund? Why not a FAST instead?

With more funds in the market than ever, managers need to stay relevant and develop new models. Blockchain and Distributed Ledger Technology are coming to the forefront of the £10tn UK Asset Management industry. With that in mind, let me introduce you to FAST, a plug-and-play tokenized investment vehicle for hands-on syndicates and accelerators.

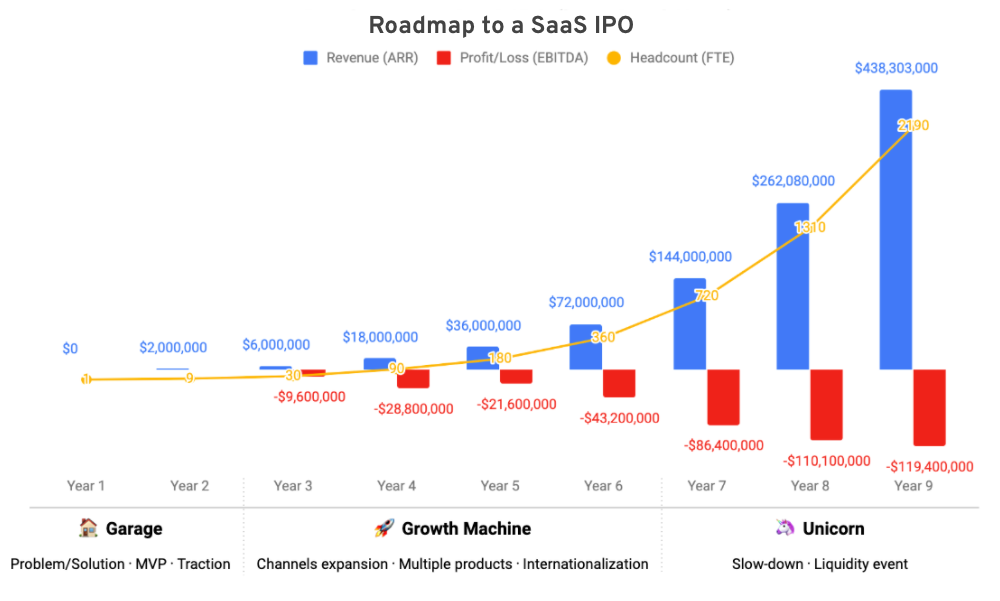

Roadmap to a SaaS IPO: how to unicorn your way to $100M revenue

Uncover 7 golden metrics leading to a SaaS IPO - timeframe, growth rate, EBITDA, funding, exit milestones, sales, and headcount.

IMAGES

VIDEO